Excel VLOOKUP for Tax Brackets Year 2021 with Examples

Posted on: 12/01/2021

Use Excel to calculate your tax liability using VLOOKUP. The Excel file is in the blog post. Tax brackets show you the tax rate you will pay on each portion of your income. For example, if you are single in 2021 and make $86,375, you are in the 22% tax bracket. You do not pay $22% on your taxable income. Twenty-two percent of $86,375 is $19,002.50.

We have a progressive tax system in the United States. You would pay 10% tax on the first 9,950 you make. You will pay 12% on the next $30,575, and you will only pay 22% on the remaining $45,850. That totals $14,751. That is a huge difference from $19,002. We will use VLOOKUP in this Excel exercise to figure out your taxable income for 2021.

VLOOKUP - Tax Brackets - Taxable income

YouTube video

Steps to figure out income tax due

-

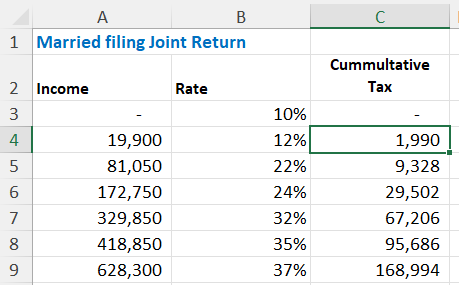

Add the header rows Income, Rate, and Cummultative Tax.

-

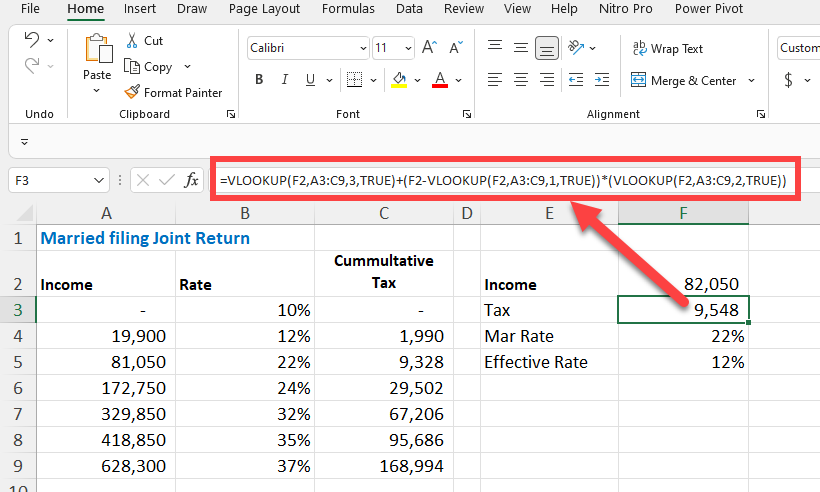

Fill in the numbers. The numbers come from the IRS, but you can find them on many websites. Make sure to put in your correct filing status numbers. Single and Married Filing a Joint Return have different numbers as an example. I'm using Married Filing a Joint Return in the example below.

Cummulatative tax - IRS tax rates

-

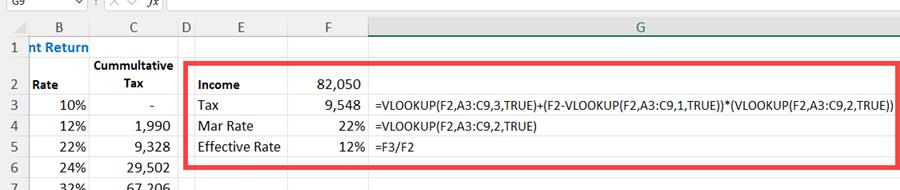

In columns E and F, put the Income, Tax, Marginal Tax Rate and Effective Rate.

-

F2 is your taxable income, not gross income, not adjusted gross income. Taxable income is after you take the Standard deduction or itemized deduction.

-

Cell F3 is the VLOOKUP Function =VLOOKUP(F2,A3:C9,3,TRUE)+(F2-VLOOKUP(F2,A3:C9,1,TRUE))*(VLOOKUP(F2,A3:C9,2,TRUE))

-

Cell F4 calculates the Marginal Tax Rate also using the VLOOKUP function =VLOOKUP(F2,A3:C9,2,TRUE)

-

The Effective Tax rate in cell F5 is a formula =F3/F2

VLOOKUP in Excel for tax brackets

Download example file: VLOOKUP Tax Brackets 2021

Recent Microsoft Teams articles

Microsoft Teams: View Only Channels

Learn how to optimize your Microsoft Teams experience by displaying only channels, hiding team names, and customizing your view for better productivity. Discover sorting options and easy switching between views.

Microsoft Teams: Edit Display Name in Meetings

Microsoft Teams is rolling out a fantastic new feature that allows you to customize your display name during meetings. This enhancement is perfect for personalizing your presence and ensuring your name appears just how you want it to.

Recent Microsoft Excel articles

Mastering Excel Slicers: A Comprehensive Guide

Excel slicers are powerful tools that enhance data filtering in Microsoft Excel, making it easier to visualize and analyze your data. In this blog, we will explore how to create and effectively use slicers, as well as their advantages and limitations in comparison to traditional filters.

Chris Menard

Chris Menard is a Microsoft Certified Trainer (MCT) and Microsoft Most Valuable Professional (MVP). Chris works as a Senior Trainer at BakerHostetler - one of the largest law firms in the US. Chris runs a YouTube channel featuring over 900 technology videos that cover various apps, including Excel, Word, PowerPoint, Zoom, Teams, Coilot, and Outlook. To date, the channel has had over 25 million views.

Menard also participates in 2 to 3 public speaking events annually, presenting at the Administrative Professional Conference (APC), the EA Ignite Conference, the University of Georgia, and CPA conferences. You can connect with him on LinkedIn at https://chrismenardtraining.com/linkedin or watch his videos on YouTube at https://chrismenardtraining.com/youtube.

Categories