PMT Function in Excel - how to use it to calculate loan payment

Posted on: 08/10/2021

One of Excel's most popular financial functions is the PMT function. The PMT function will calculate your payments for a loan based on the interest rate, loan amount, and the number of periods. You would use the PMT function to calculate a car or house loan.

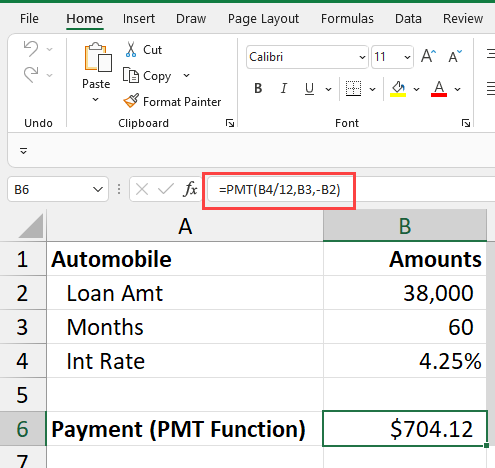

PMT function for a car loan

YouTube video

PMT Function Syntax

PMT(rate, nper, pv, [fv], [type])

Examples of the PMT Function

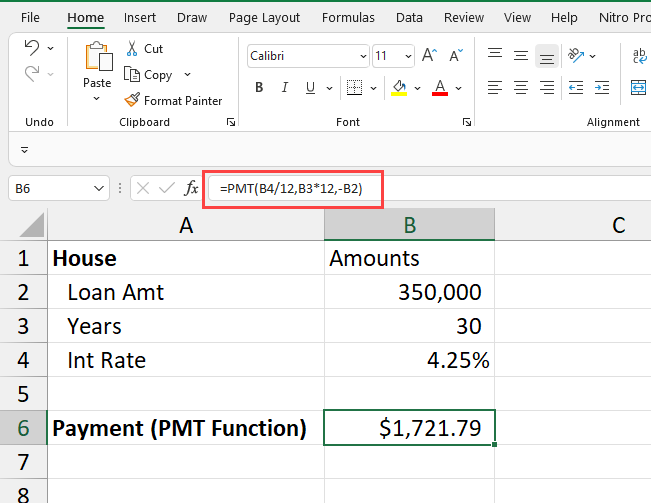

Example 1: =PMT(4.25%/12,30*12,350000)

Example 1 is a PMT function not referencing cells. You will get a negative answer since it is money you have to pay. To make the answer positive, use -350000 in the formula.

Example 2: =PMT(b4/12,b3*12,-b2)

Example 2 is referencing cells. See the screenshot below.

Five arguments in the PMT function

-

rate - The interest rate for the loan.

-

nper - The total number of payments for the loan.

-

pv - The present value, or the total value of all loan payments now.

-

fv - [optional] The future value or a cash balance you want after the last payment is made. Defaults to 0 (zero).

-

type - [optional] When payments are due. 0 = end of the period. 1 = beginning of the period. Default is 0.

Tip: Wondering why [fv] and [type] are in square brackets? The brackets mean they're optional. If you don't include values for fv and type in your formula, Excel assumes your balance will be $0 at the end of the loan, and that your payments are due at the end of the period.

PMT function for a house loan

Other Excel articles

Mastering Excel Slicers: A Comprehensive Guide

Excel slicers are powerful tools that enhance data filtering in Microsoft Excel, making it easier to visualize and analyze your data. In this blog, we will explore how to create and effectively use slicers, as well as their advantages and limitations in comparison to traditional filters.

Analyzing 50+ Years of Mortgage Rates in Excel: Insights and Trends

Understanding mortgage rates is crucial for anyone looking to buy a home or refinance their existing mortgage. In this comprehensive analysis, we'll dive deep into over 50 years of mortgage rate data using Microsoft Excel. We'll explore historical trends, calculate key statistics, and examine how changes in interest rates impact monthly payments.

Chris Menard

Chris Menard is a Microsoft Certified Trainer (MCT) and Microsoft Most Valuable Professional (MVP). Chris works as a Senior Trainer at BakerHostetler - one of the largest law firms in the US. Chris runs a YouTube channel featuring over 900 technology videos that cover various apps, including Excel, Word, PowerPoint, Zoom, Teams, Coilot, and Outlook. To date, the channel has had over 25 million views.

Menard also participates in 2 to 3 public speaking events annually, presenting at the Administrative Professional Conference (APC), the EA Ignite Conference, the University of Georgia, and CPA conferences. You can connect with him on LinkedIn at https://chrismenardtraining.com/linkedin or watch his videos on YouTube at https://chrismenardtraining.com/youtube.

Categories