Mastering Loan Amortization: A Comprehensive Guide to Understanding and Comparing Loans

Understanding loan amortization is crucial for anyone considering a major purchase, particularly a home. With recent changes in interest rates, it's more important than ever to grasp how loan amortization works and how to compare different loan options. This comprehensive guide will walk you through the ins and outs of loan amortization schedules, helping you make informed decisions about your financial future.

What is Loan Amortization?

Loan amortization is the process of paying off a loan through regular payments over time. These payments typically include both principal and interest, with the proportion of each changing as you progress through the loan term. Understanding loan amortization is essential for several reasons:

- It helps you see how much of each payment goes towards the principal versus interest

- It allows you to track your loan balance over time

- It enables you to compare different loan options effectively

- It can help you plan for early payoff strategies

YouTube Video: Loan Amortization Schedule

Excel Loan Amortization Schedule: New Lower Interest Rates - Compare Loans! - YouTube

The Power of Loan Amortization Schedules

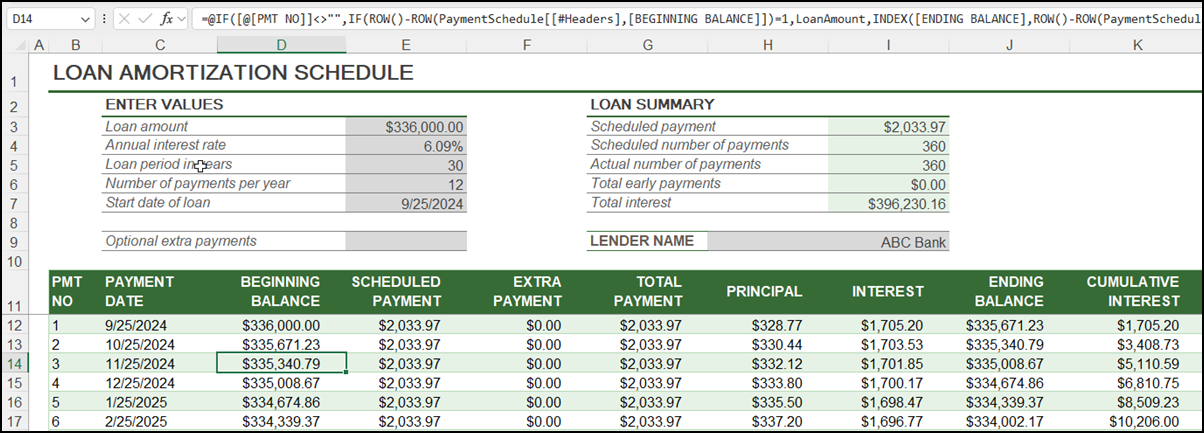

A loan amortization schedule is a powerful tool that breaks down each payment over the life of your loan. It typically includes the following information:

1. Payment number 2. Payment date 3. Payment amount 4. Principal paid 5. Interest paid 6. Remaining balance

One of the most user-friendly and accessible loan amortization schedules is provided by Microsoft Excel. This free tool allows you to input your loan details and instantly generate a comprehensive amortization schedule.

Setting Up Your Loan Amortization Schedule

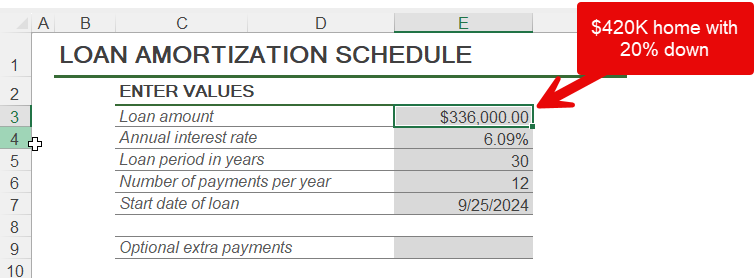

To get started with your loan amortization schedule, you'll need to gather some key information about your potential loan. Here's what you'll typically need to input:

- Loan amount - Down payment (if applicable) - Annual interest rate - Loan term (in years) - Number of payments per year - Start date of the loan

Once you've entered this information, the amortization schedule will automatically populate, showing you a detailed breakdown of each payment over the life of your loan.

Understanding Your Amortization Schedule

As you review your amortization schedule, you'll notice some interesting patterns:

- In the early years of your loan, a larger portion of each payment goes towards interest - As time progresses, more of each payment is applied to the principal - The total amount you pay over the life of the loan becomes clear

This information can be eye-opening, especially when you realize how much interest you'll pay over the course of a 30-year mortgage. It's this kind of insight that can motivate borrowers to consider strategies for paying off their loans early or exploring different loan terms.

Comparing Multiple Loans

One of the most valuable aspects of using a loan amortization schedule is the ability to compare different loan options side by side. This becomes particularly important in a changing interest rate environment. As of September 2024, we've seen the first interest rate cut in over four years, with the Federal Reserve lowering the benchmark short-term rate by 50 basis points.

To compare loans using the Excel amortization schedule:

1. Set up your first loan scenario in the provided fields 2. Copy the formulas from the first scenario to an adjacent column 3. Adjust the loan details for your second scenario 4. Compare the results side by side

This method allows you to easily see how different loan amounts, interest rates, or terms can affect your monthly payments and total interest paid over the life of the loan.

Beyond Principal and Interest: Additional Costs to Consider

While the loan amortization schedule focuses on principal and interest, it's crucial to remember that your total housing costs may include additional expenses. When comparing loans and budgeting for your new home, be sure to account for:

- Property taxes

- Homeowners insurance

- Private Mortgage Insurance (PMI) if your down payment is less than 20%

- Homeowners Association (HOA) fees, if applicable

PITI stands for principal, interest, taxes, and insurance, and is an acronym used to describe the four main components of a monthly mortgage payment. The two additional components are PMI, and HOA fees.

These additional costs can significantly impact your monthly housing expenses and should be factored into your decision-making process.

Strategies for Optimizing Your Loan

Armed with the insights from your loan amortization schedule, you can explore strategies to optimize your loan and potentially save money over time:

1. Make Extra Payments

By making additional payments towards your principal, you can reduce the overall interest paid and shorten the life of your loan. Even small extra payments can make a significant difference over time.

2. Refinance When Rates Drop

Keep an eye on interest rates. If they drop significantly below your current rate, refinancing could lead to lower monthly payments or a shorter loan term.

3. Choose a Shorter Loan Term

While 30-year mortgages are common, opting for a 15-year term can result in substantial interest savings over the life of the loan, albeit with higher monthly payments.

4. Make Bi-Weekly Payments

By making half your monthly payment every two weeks, you end up making an extra full payment each year, reducing your principal faster and saving on interest.

FAQs About Loan Amortization

Q: What is the difference between a loan amortization schedule and a mortgage statement?

A: A loan amortization schedule shows the entire repayment plan for your loan from start to finish, while a mortgage statement is a monthly record of your payment and current loan balance.

Q: Can I pay off my loan early using insights from the amortization schedule?

A: Yes, the amortization schedule can help you see how extra payments can reduce your principal and overall interest, potentially allowing you to pay off your loan earlier.

Q: How often should I review my loan amortization schedule?

A: It's a good idea to review your schedule annually or whenever you're considering making changes to your loan, such as refinancing or making extra payments.

Q: Does the loan amortization schedule account for variable interest rates?

A: Most basic amortization schedules assume a fixed interest rate. For variable rate loans, you may need a more advanced calculator or to update your schedule as rates change.