Social Security - Breakeven point in Years using Excel

Understanding the SSA Breakeven Age

The Social Security breakeven age is a critical concept for anyone planning their retirement. It represents the point at which the cumulative benefits of taking Social Security early (at age 62) equal the benefits of waiting until full retirement age (67).

I'm using 62 and 67, but this would work for any retirement age. For example, you could compare retiring at 64 vs. 66.

In this guide, I will explain how to calculate the SSA breakeven age using two different methods. This will help you make an informed decision about when to start collecting your benefits.

YouTube Video

Early vs. Full Retirement - What is the breakeven age for SSA Benefits? - YouTube

Excel File for Download

**[https://chrismenardtraining.com/Files/DownloadFile.aspx?FUID=94bdc604-dc30-4fe6-8d24-dd099eeef857](https://chrismenardtraining.com/Files/DownloadFile.aspx?FUID=94bdc604-dc30-4fe6-8d24-dd099eeef857)**

Method 1: Calculating Breakeven Age Using Excel / Calculator

Let's start with a simple calculation that you can easily do on your calculator or mobile phone. For demonstration purposes, I will also show you how to plot this out in Excel.

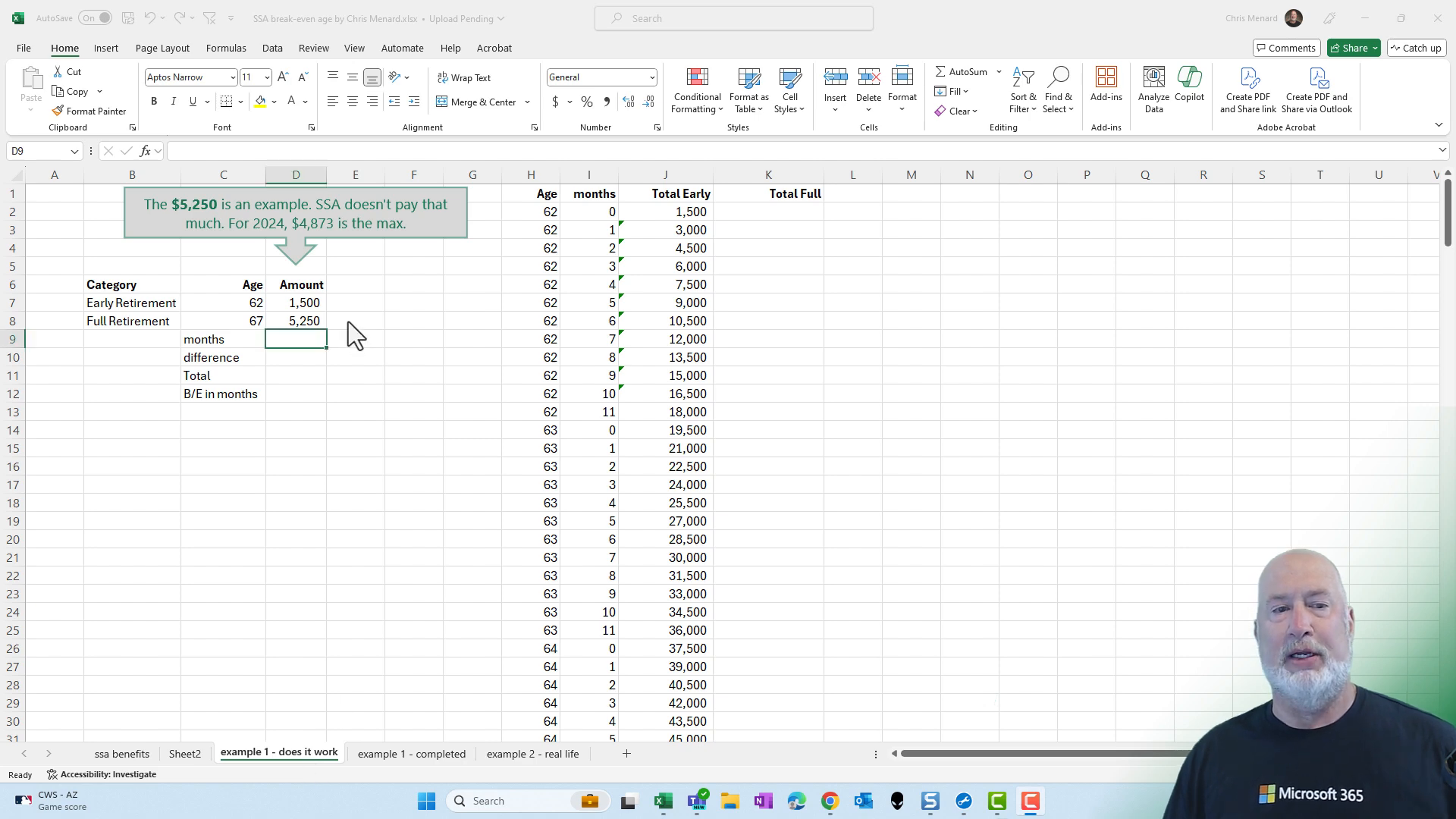

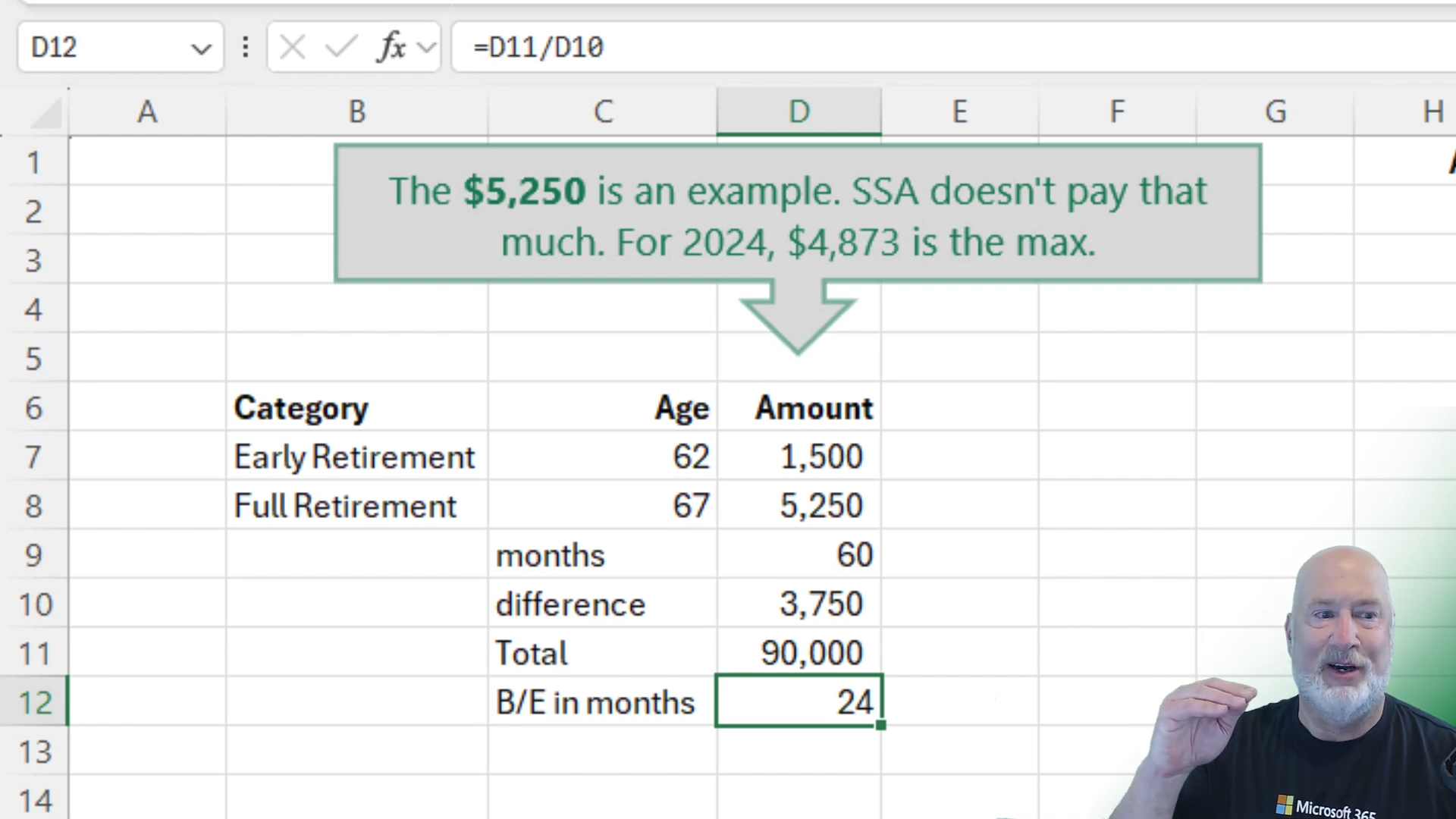

First, let's look at an example with some hypothetical numbers to prove the formula works.

Setting Up the Calculation

For this example, assume you have two options:

- Take early retirement at age 62 and receive $1,500 per month. - Wait until full retirement at age 67 and receive $5,250 per month.

The first example is for illustration purposes only. In 2024, the maximum monthly benefit amount if you retire at age 70 is $4,873 ($58,476 annually). I used 5,250 to get a whole number in my calculation.

Calculating the Difference

The difference between the two amounts is $3,750 ($5,250 - $1,500). Next, calculate the total amount you would receive from age 62 to 67 if you take early retirement:

$1,500 per month x 60 months = $90,000.

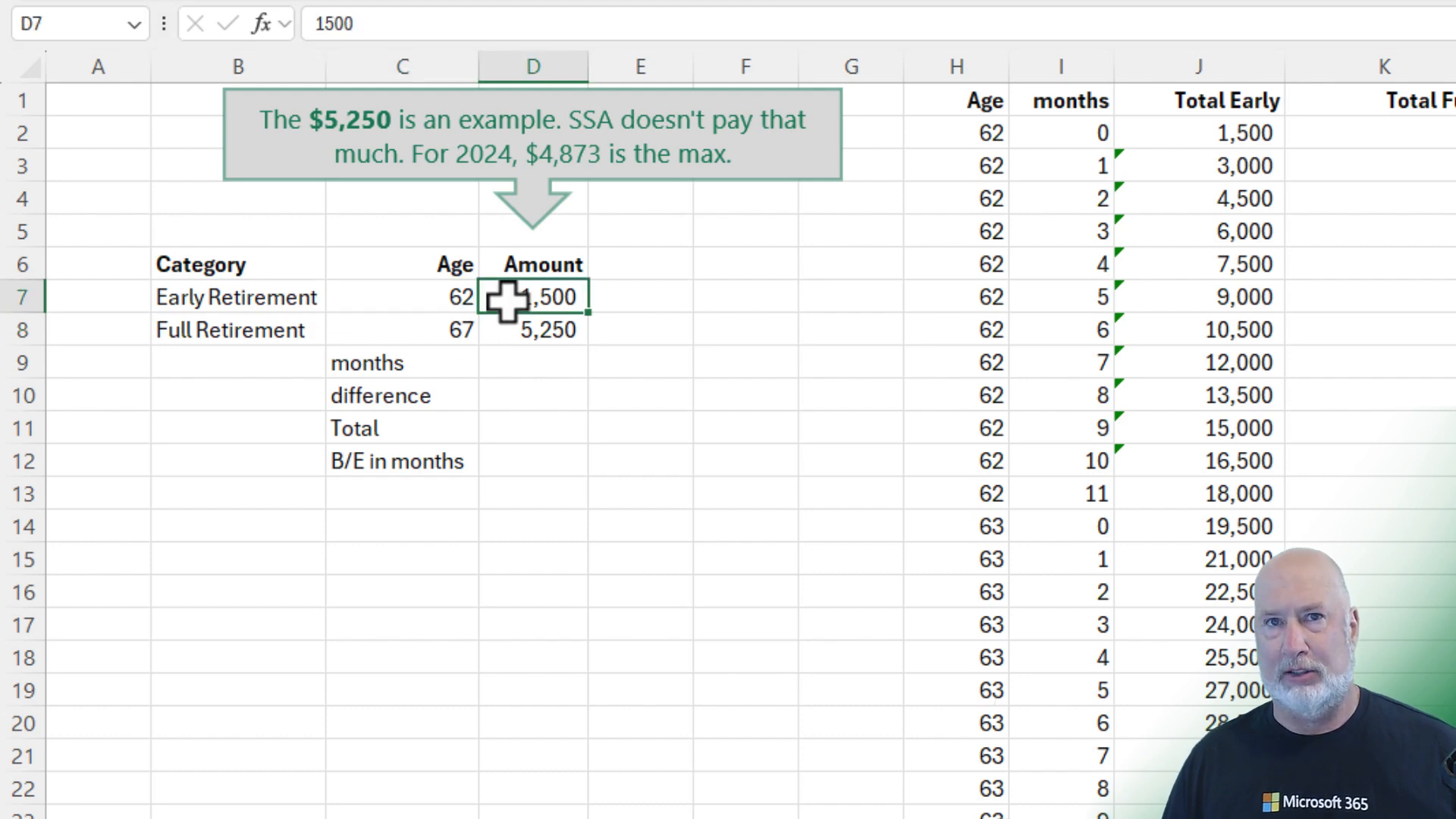

Finding the Breakeven Point

Now, divide the total amount by the difference:

$90,000 / $3,750 = 24 months.

This means it will take 24 months from age 67 for the benefits to break even. That would be the right before you turn 69.

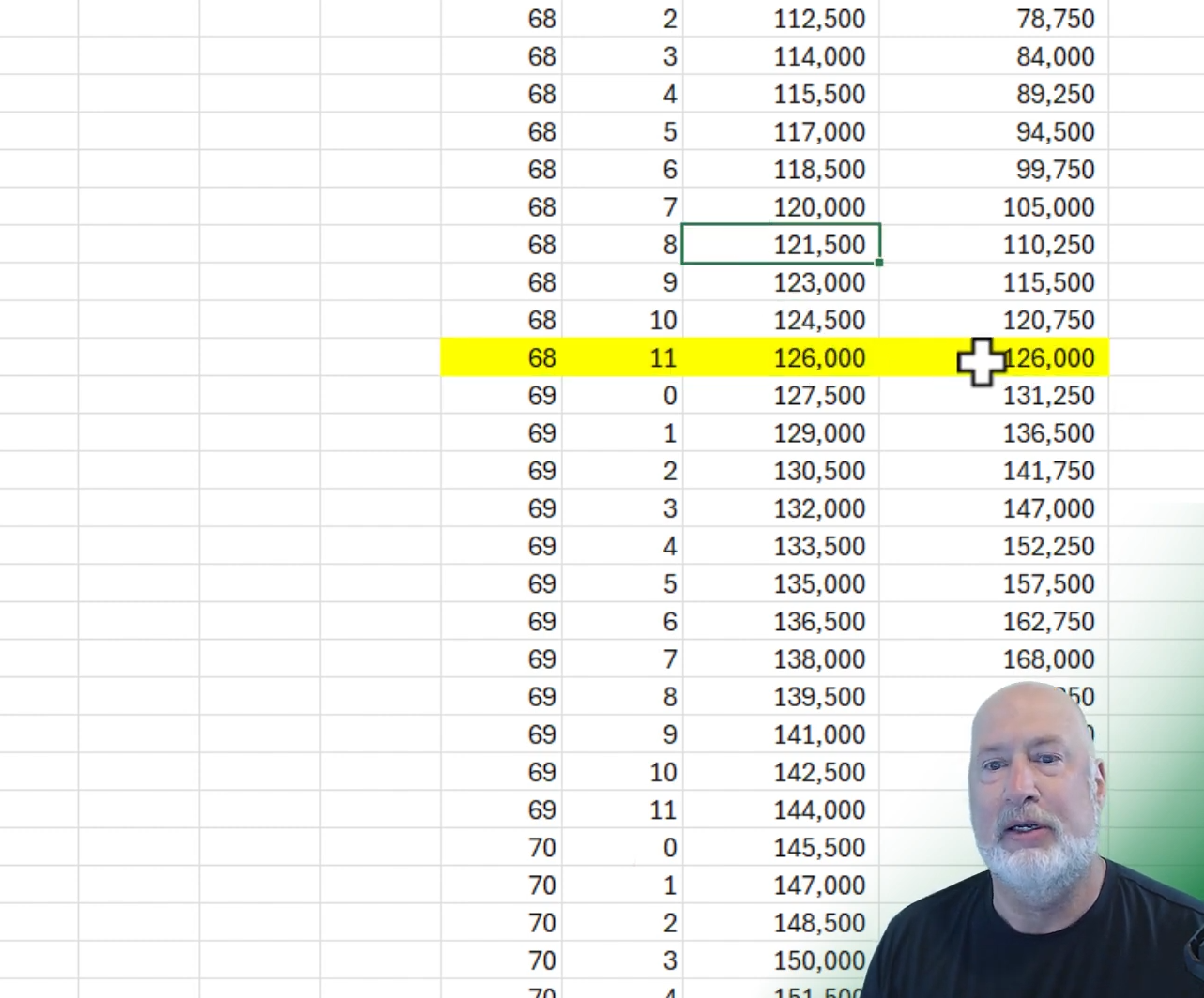

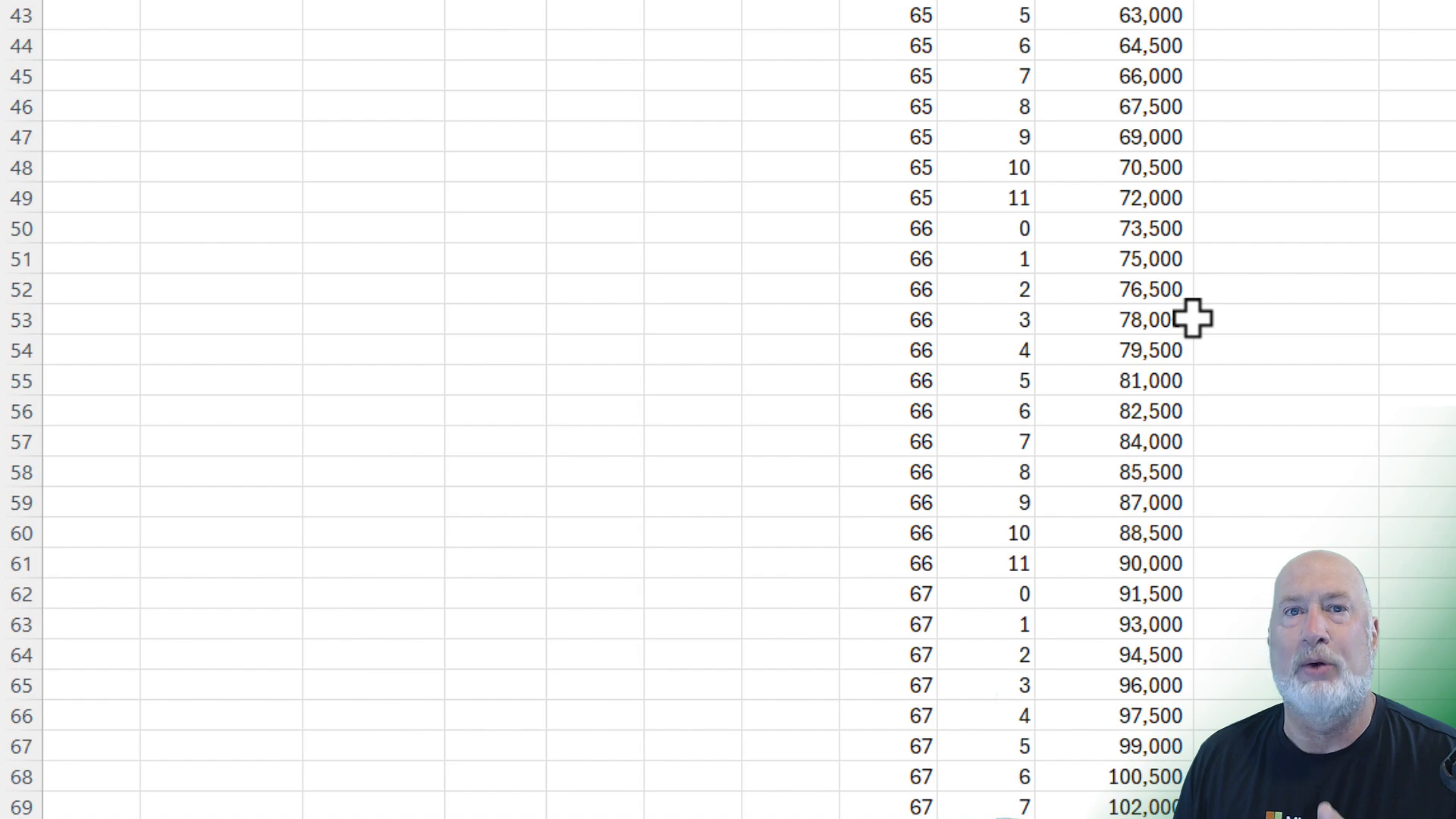

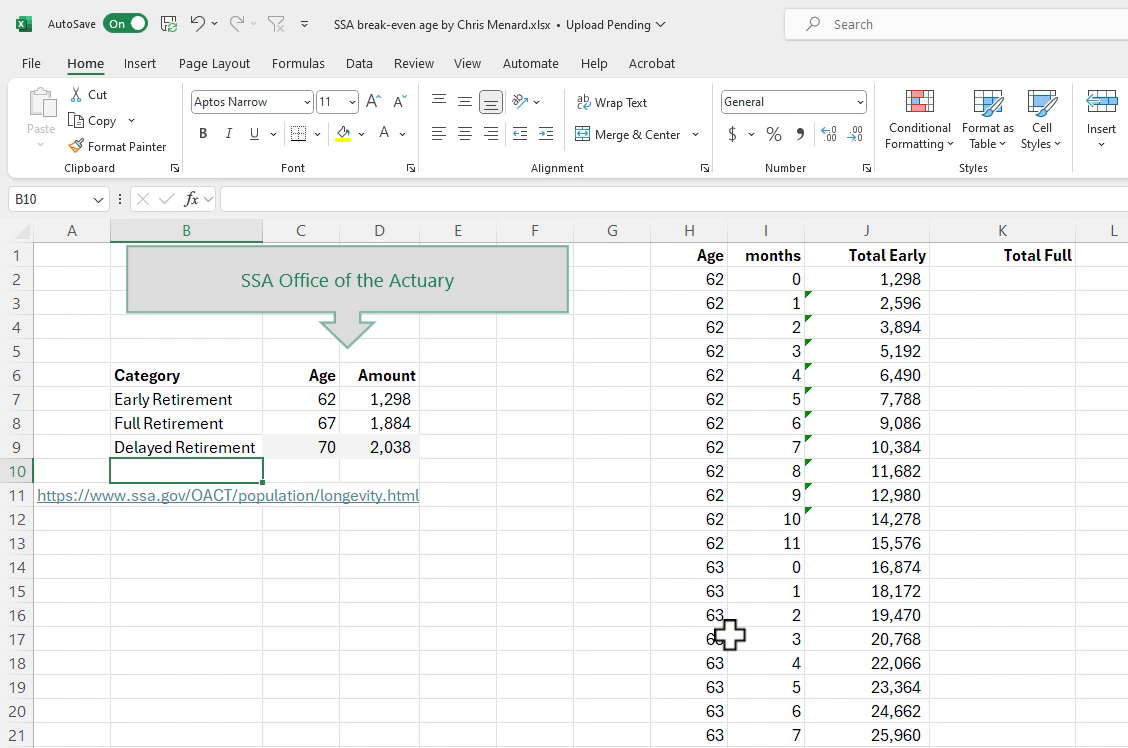

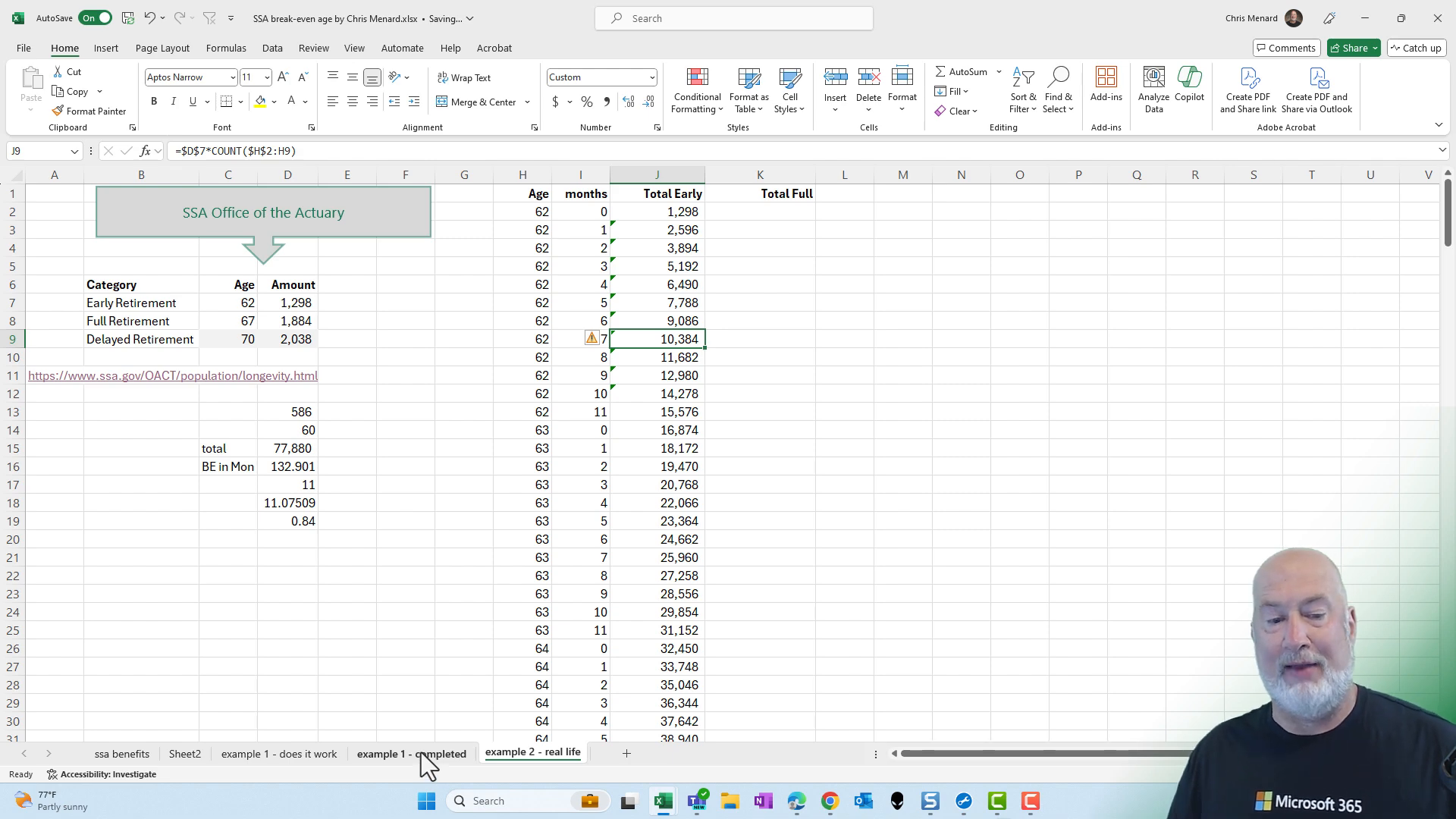

Method 2: Using Realistic Numbers and SSA Data

Now, let's look at a more realistic scenario using data from the Social Security Administration (SSA). You can access your work history and earnings from the SSA website to get accurate numbers.

Using SSA Data

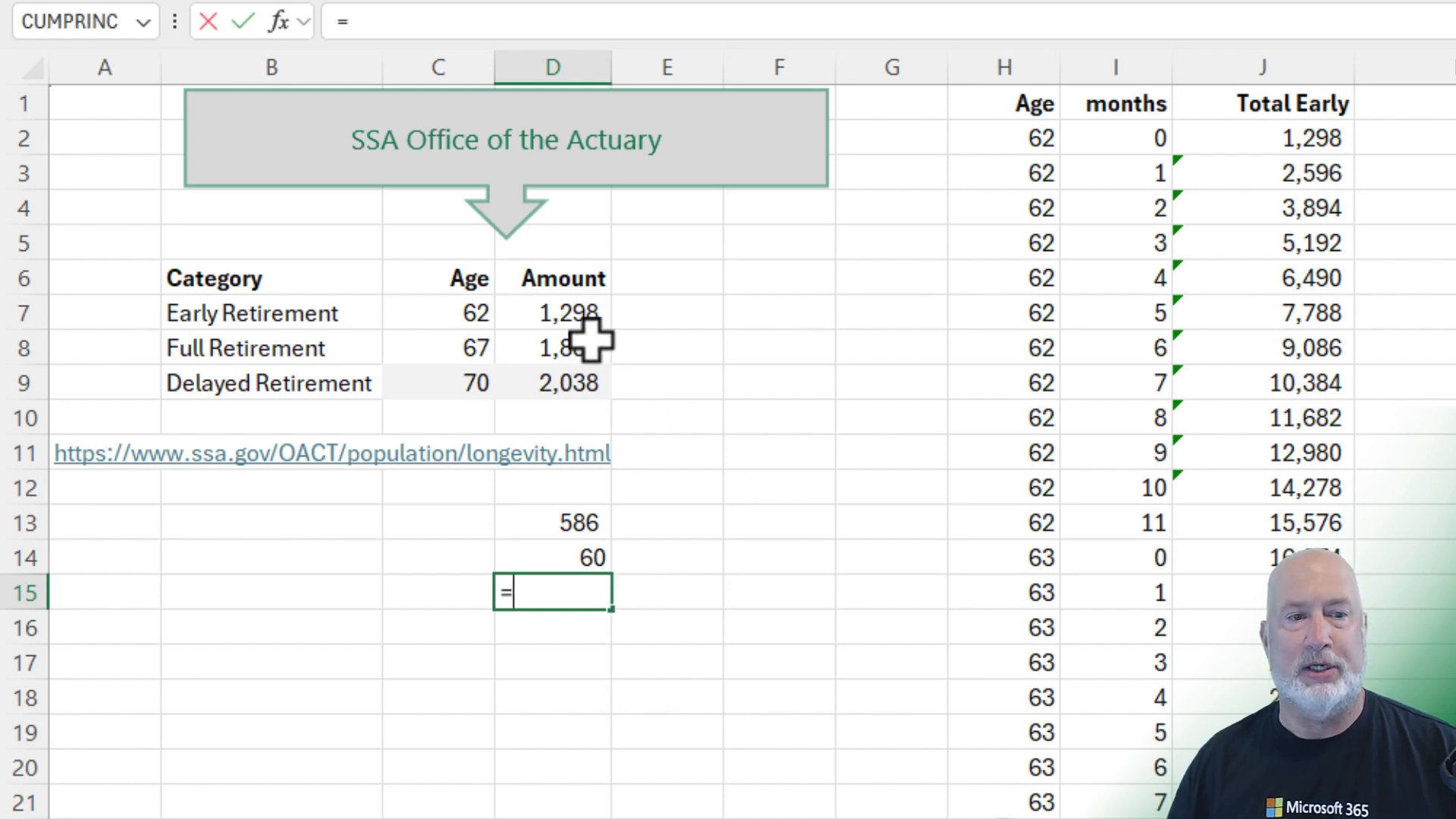

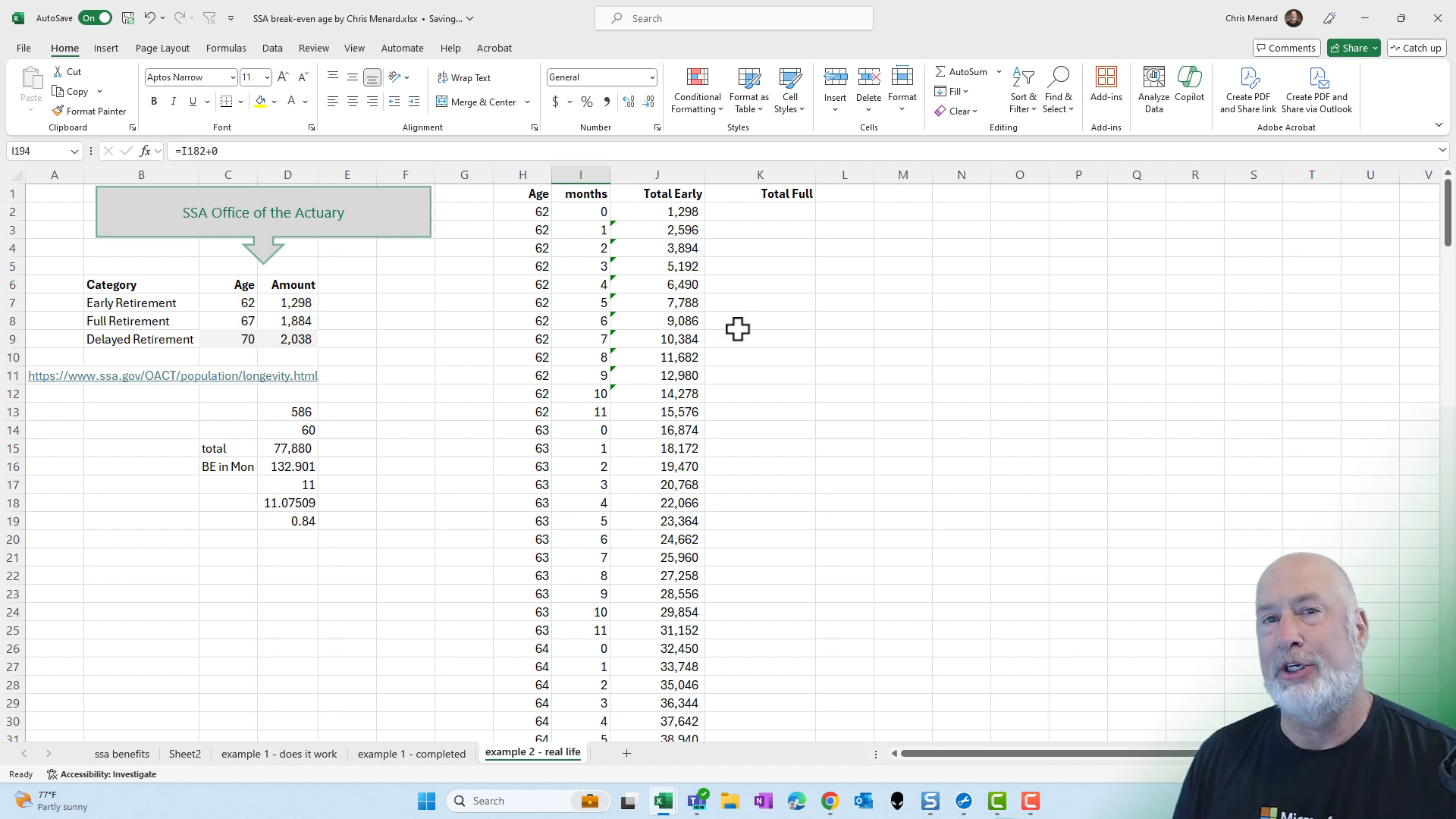

For this example, the numbers are derived from the Office of Actuary for the Social Security Administration as of December 2023 or early 2024.

Averages for retirees from Social Security Administration

- 62 years old $1,298 - 67 years old $1,884 - 70 years old $2,038

Let's compare early retirement at age 62 and full retirement at age 67:

Detailed Calculation

Assume you receive $1,500 per month at age 62 and $1,884 per month at age 67. The difference is $384 per month. Calculate the total amount received from age 62 to 67:

$1,500 per month x 60 months = $90,000.

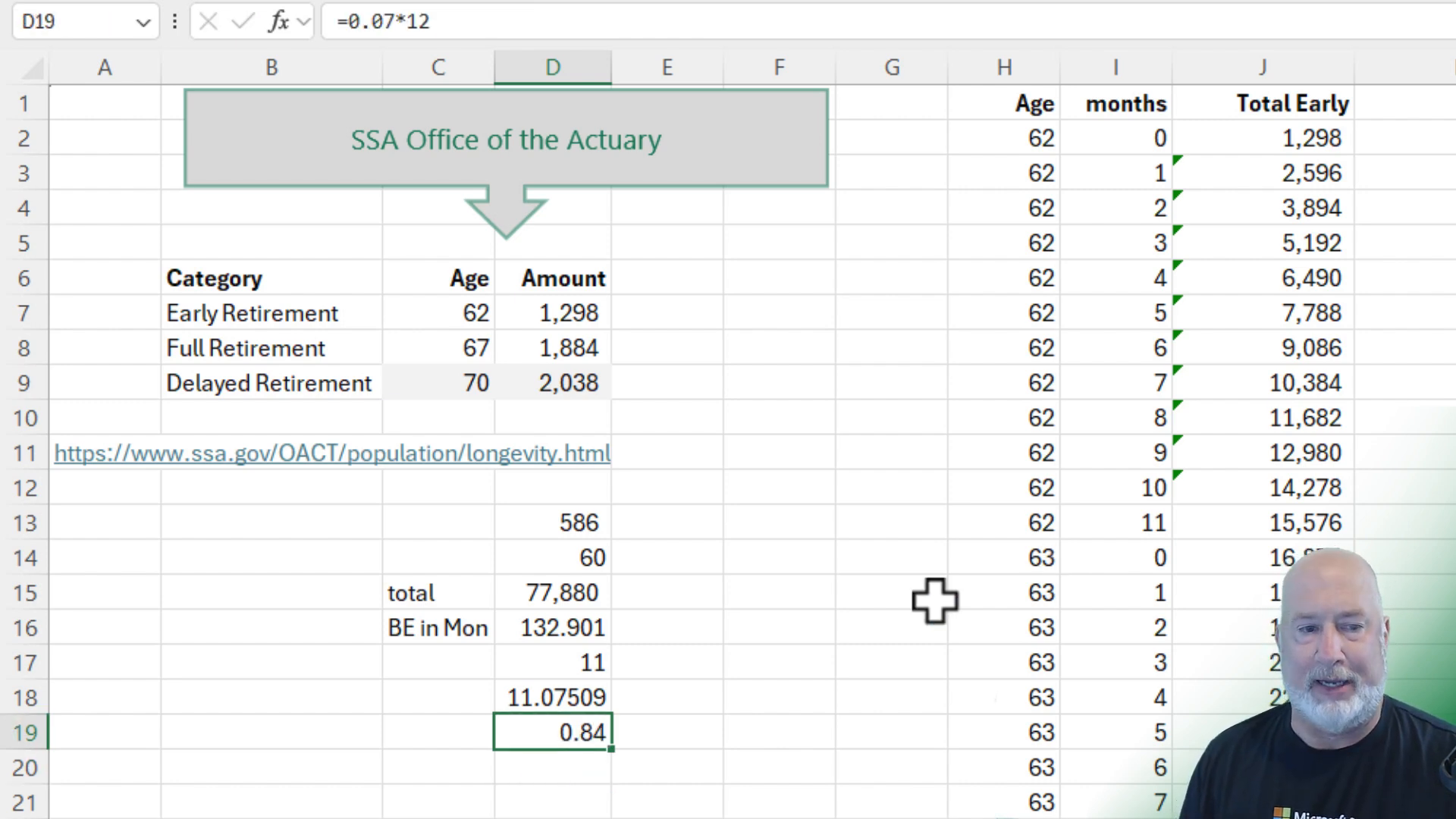

Breakeven in Realistic Terms

Divide the total amount by the difference:

$90,000 / $384 = approximately 235 months or 19.6 years.

This means the breakeven point is around 19.6 years after age 67, or roughly at age 86.6.

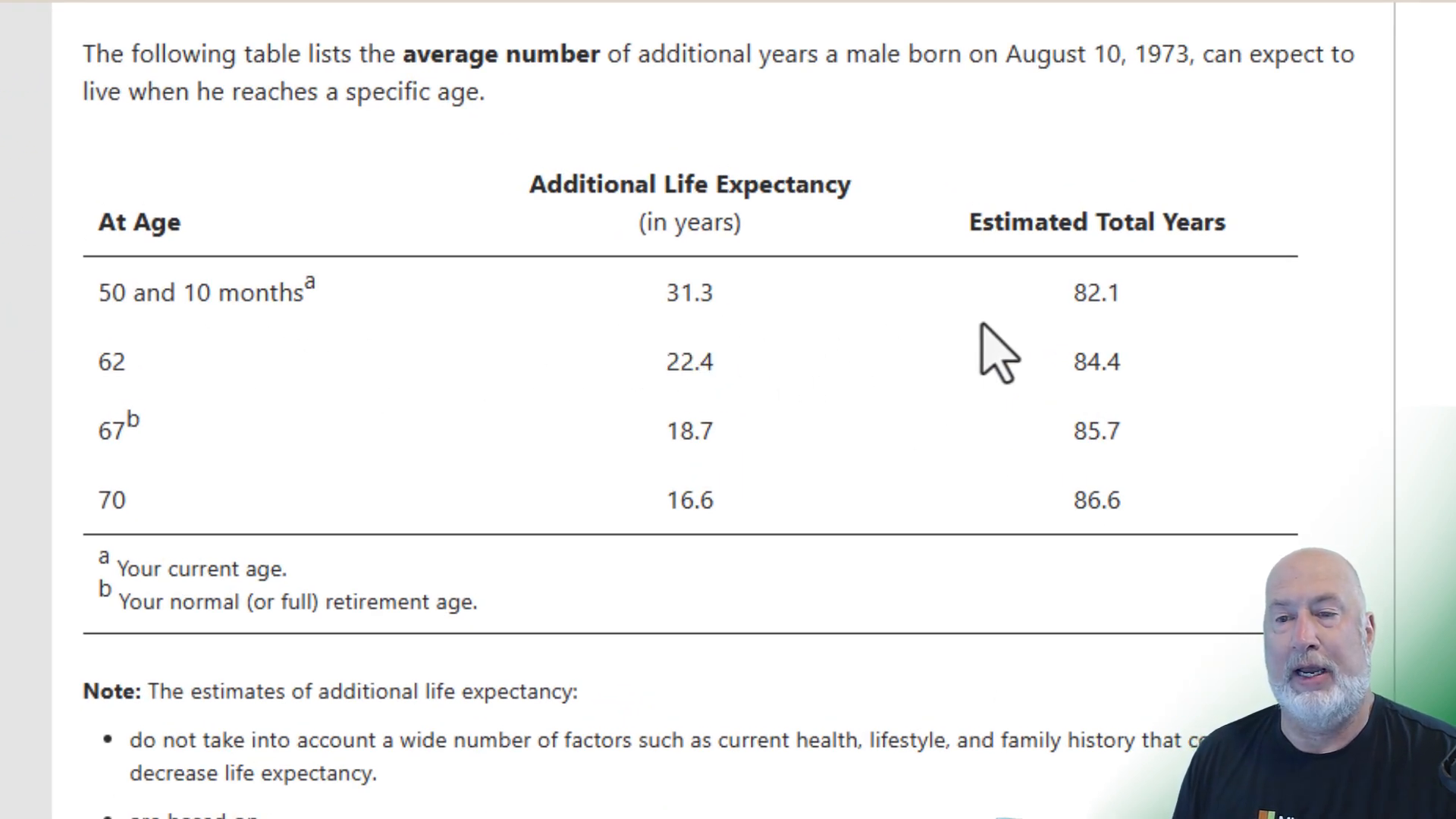

Life Expectancy and Retirement Planning

When planning your retirement, it's essential to consider life expectancy. The Social Security Administration provides a life expectancy calculator that can help you estimate how long you might live based on your gender and date of birth.

Using the SSA Life Expectancy Calculator

Visit the SSA website and select your gender. Enter your date of birth, and the calculator will provide an estimate of your life expectancy.

Making Informed Decisions

Use this information to make an informed decision about when to start collecting your Social Security benefits. Remember, the longer you wait, the higher your monthly benefit will be.

Conclusion and Additional Resources

Understanding the SSA breakeven age and considering life expectancy are crucial steps in retirement planning. While the calculations provided here are simplified, they offer a solid foundation for making informed decisions.

If you need more detailed guidance, consider consulting a certified financial planner. They can help you navigate the complexities of retirement planning and ensure you make the best choices for your financial future.

For more information and tools, visit the Social Security Administration's website and use their resources to plan your retirement effectively.

Thank you for reading. For more helpful content, feel free to subscribe to my Excel online training courses and YouTube channel.