Liquidity Ratio using Excel

Posted on: 08/21/2022

A liquidity ratio is a type of Financial Ratio that determines if a company can pay its short-term debt and obligations with its current assets. The higher the liquidity ratio, the better.

What are Current Assets?

Current Assets consist of cash and other assets expected to be converted to cash within a year.

Examples of Current Assets:

-

Cash

-

Cash Equivalents

-

Accounts Receivable

-

Inventory

-

Prepaid Expenses

-

Other Liquid Assets

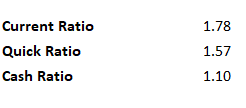

Liquidity Ratios

-

Current Ratio

-

Quick Ratio

-

Cash Ratio

Liquidity Ratios

YouTube video of Liquidity Ratios

Current Ratio

The current ratio compares current assets to current liabilities.

Current Ratio Formula

Current Assets / Current Liabilites

Excel chart articles

-

Excel Charts vs PivotCharts | Comparison | Which is Best?

Which is best in Excel? Classic CHARTS or PIVOTCHARTS? In today's Excel video, I show you both ways of creating charts in Excel, show you step by step what's involved in each method and which one is the most flexible, powerful and which one I prefer.

-

Three tips for getting started with Excel Charts

Charts in Microsoft Excel are easy. This short video shows three tips for creating charts. I'll cover two keyboard shortcuts for making charts, using Recommend Charts, and creating charts using Quick Analysis.

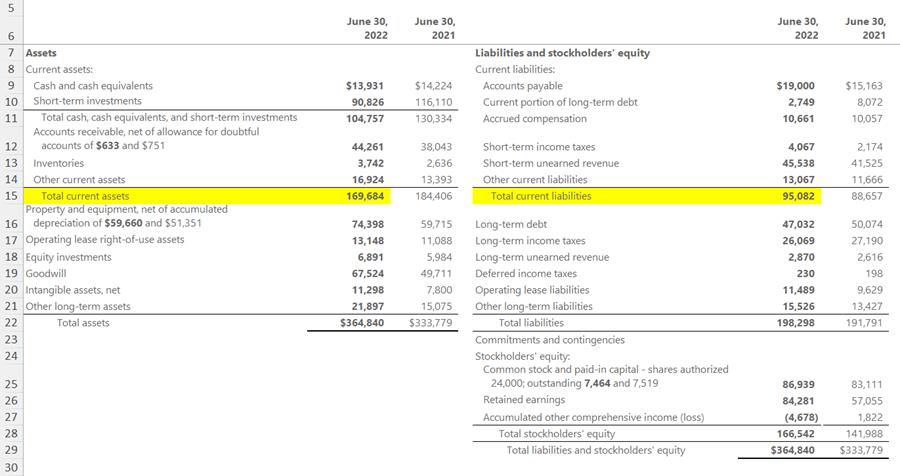

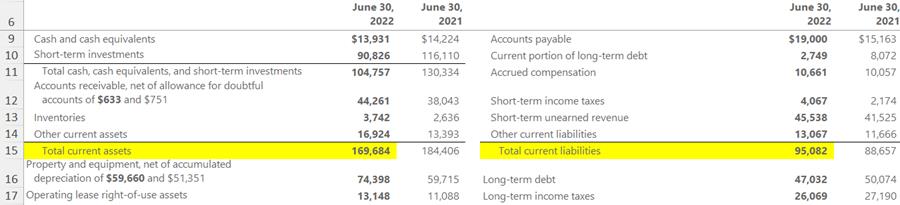

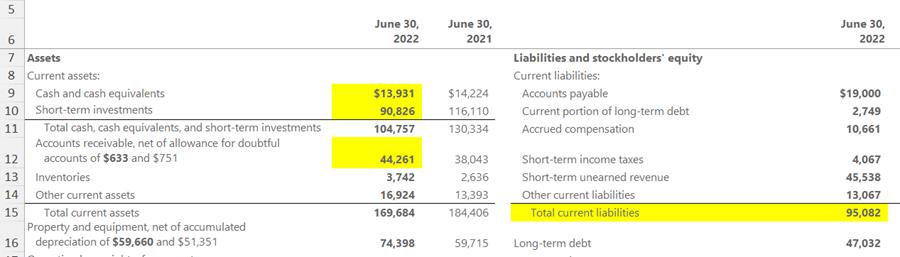

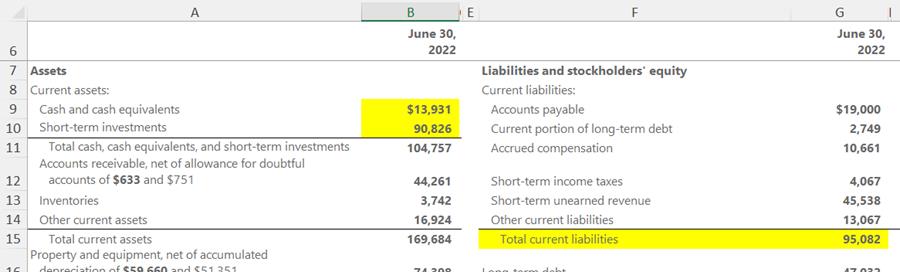

Current Ratio - Current Assets / Current Liabilities

169,694 / 95,082 = 1.78

Quick Ratio

The quick ratio compares highly liquid current assets to current liabilities.

Quick Ratio Formula

Cash + Cash Equivalents + Marketable Securities + Net Accounts Receivable / Current Liabilites

Notice that inventory and prepaid expenses are not included in the quick ratio.

Quick Ratio

(13,931+90,826+44,261) / 95,082 = 1.57

Cash Ratio

The cash ratio compares highly liquid current assets, cash and cash equivalents to current liabilities.

Cash Ratio Formula

Cash + Cash Equivalents / Current Liabilites

Notice that accounts receivable, inventory, and prepaid expenses are not included in the cash ratio.

Cash Ratio

(13,931+90,826) / 95,082 = 1.10

Liquidity Ratios Observations

A few observations:

-

Notice the ratios goes down from 1.78, the current ratio, to 1.10 for the quick ratio. The numbers go down as current assets are eliminated.

-

All three ratios are based on current liabilities.

-

There are other liquidity ratios. Only three are covered in this article.

Ratios goes down as assets are eliminated from the formula

Recent Articles

Nov 4, 2025 - Executive Insights: Harnessing Excel for Strategic Analysis

Nov 4, 2025 - Join us on November 4, 2025, for a live, in-person training: Executive Insights – Harnessing Excel for Strategic Analysis. Learn how to master Power Query, PivotTables, data cleaning, sorting and filtering, conditional formatting, and charts to create impactful reports and support leadership with confidence. Perfect for Executive Administrative Professionals looking to boost efficiency and deliver data-driven insights.

Summarize Outlook Attachments with Copilot

In today’s fast-paced digital world, managing emails efficiently is crucial, especially when it comes to handling attachments. I demonstrate an exciting new feature that has rolled out in Microsoft Outlook’s Copilot — the ability to summarize Outlook attachments with Copilot

Copilot in Word: Quickly Add Numbers with Ease

Discover how Copilot in Microsoft Word can quickly and accurately add numbers within your documents, saving you time and reducing errors. Learn to streamline your workflow with this intelligent assistant.

Chris Menard

Chris Menard is a Microsoft Certified Trainer (MCT) and Microsoft Most Valuable Professional (MVP). Chris works as a Senior Trainer at BakerHostetler - one of the largest law firms in the US. Chris runs a YouTube channel featuring over 900 technology videos that cover various apps, including Excel, Word, PowerPoint, Zoom, Teams, Coilot, and Outlook. To date, the channel has had over 25 million views.

Menard also participates in 2 to 3 public speaking events annually, presenting at the Administrative Professional Conference (APC), the EA Ignite Conference, the University of Georgia, and CPA conferences. You can connect with him on LinkedIn at https://chrismenardtraining.com/linkedin or watch his videos on YouTube at https://chrismenardtraining.com/youtube.

Categories