Ally Bank Smart Savings with Buckets and Boosters

Posted on: 02/24/2022

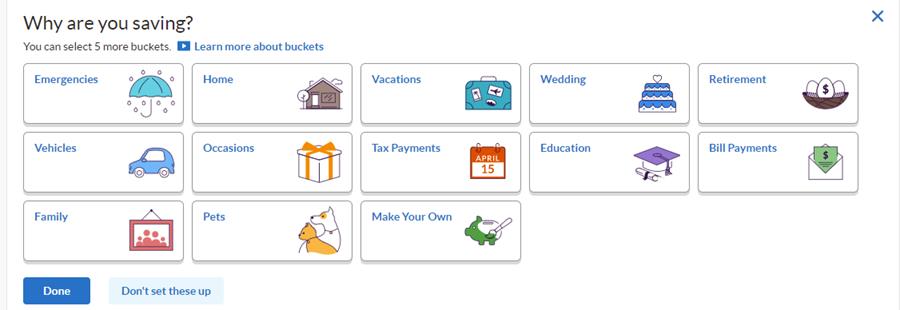

Ally Bank has Buckets and Boosters to assist in optimizing savings. Buckets are digital envelopes. You can have 10 buckets in your savings account. You can have buckets for emergencies, vacations, wedding, bill payments, car repairs, education, pet needs, and other buckets. You can even create your own bucket and set goals and target dates. Boosters are how you fund your buckets. Do you get paid every week or twice a month? Set up boosters so funds automatically flow into your buckets.

Ally Bank - Buckets

Ally Bank Buckets live inside your Saving account. You can fund your buckets with your checking or saving account, but ideally, you would fund buckets with your checking account. I fund my buckets on my pay dates.

Ally Bank Buckets

-

Emergencies

-

Home

-

Vacations

-

Wedding

-

Retirement

-

Vehicles

-

Occasions

-

Tax Payments

-

Education

-

Bill Payments

-

Family

-

Pets

You can even make your own bucket.

YouTube video

Other Personal Finance articles

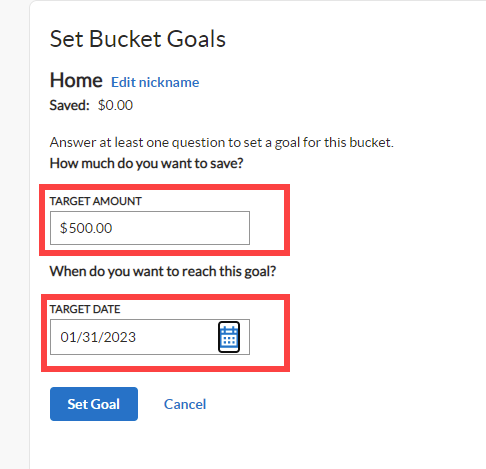

Setting up Buckets

-

Sign into Ally Bank. Ideally, you have a checking and saving account, but you can do this with just a saving account.

-

Click your saving account.

-

Click Optimize using Buckets

-

Click Done

-

Set Target Amount - not required but suggest you do. For example, I need $500 for vacation bucket.

-

Set Target Date - not required but suggest you do. For example,I need the Target Amount by August 31st

Ally Bank Buckets - Target Amount and Date

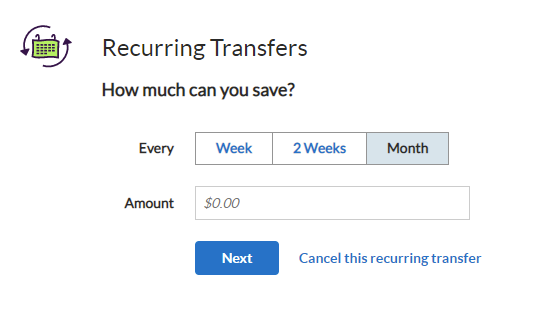

Ally Bank Boosters (Recurring Transfers)

Boosters are how you fund your buckets. You set up Boosters to automatically take money from your checking account, usually on a payday, and move it to your buckets. Boosters are Recurring Transfers. There are a total of three boosters, but I use Recurring Transfers. The other two are to round up your debit card spending and move to savings or buckets, and let Ally bank determine if you have excess funds in your checking, and automatically move money. I'm not too fond of the last option, but it is available.

Ally Bank - Recurring Transfers

Recent Excel articles

Mastering Excel Slicers: A Comprehensive Guide

Excel slicers are powerful tools that enhance data filtering in Microsoft Excel, making it easier to visualize and analyze your data. In this blog, we will explore how to create and effectively use slicers, as well as their advantages and limitations in comparison to traditional filters.

Chris Menard

Chris Menard is a Microsoft Certified Trainer (MCT) and Microsoft Most Valuable Professional (MVP). Chris works as a Senior Trainer at BakerHostetler - one of the largest law firms in the US. Chris runs a YouTube channel featuring over 900 technology videos that cover various apps, including Excel, Word, PowerPoint, Zoom, Teams, Coilot, and Outlook. To date, the channel has had over 25 million views.

Menard also participates in 2 to 3 public speaking events annually, presenting at the Administrative Professional Conference (APC), the EA Ignite Conference, the University of Georgia, and CPA conferences. You can connect with him on LinkedIn at https://chrismenardtraining.com/linkedin or watch his videos on YouTube at https://chrismenardtraining.com/youtube.

Categories