5 things to do before closing your Simple Bank Account

Posted on: 04/06/2021

Simple Bank is closing on May 8, 2021.This article is part of a series of personal finance articles centered around the transition of Simple Bank accounts to BBVA. This article has a specific audience: Simple Bank customers who may not want their accounts to be taken over by BBVA USA.

If you don't want your Simple Bank account transitioning to BBVA USA, you can close it following the steps at the end of this article, but before you do that, there are several things you should do:

Download recent statements

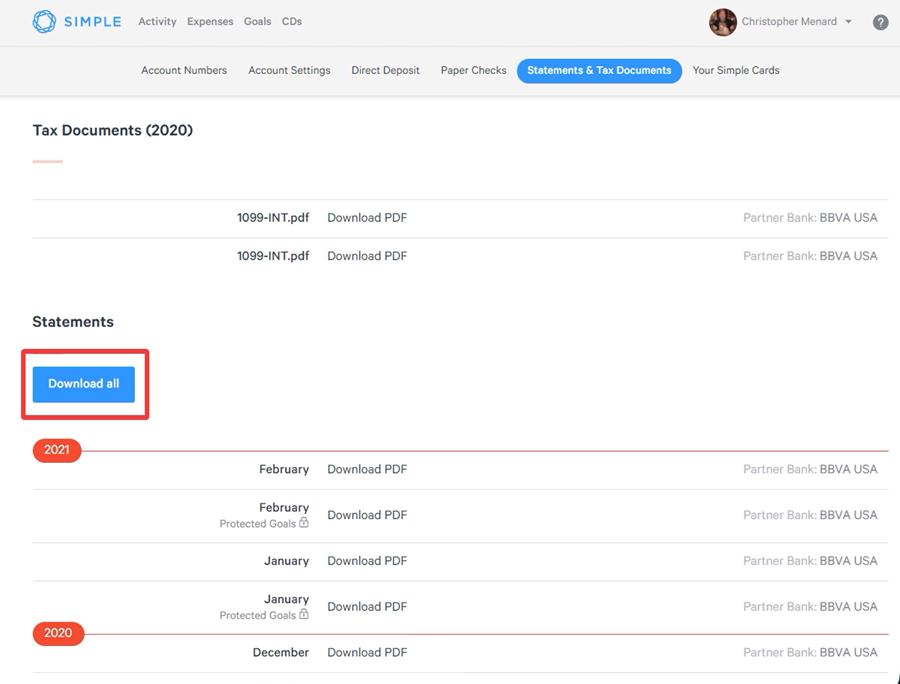

Before you close your Simple checking account, you should download your recent bank statements. If you decide to purchase a home or you need a history of your transactions for whatever reason, it’s a good idea to download your bank statements before you close your Simple Bank account. You can download all of them but I recommend downloading at least the last three months.

How to download your statements:

-

Sign into your Simple Bank account

-

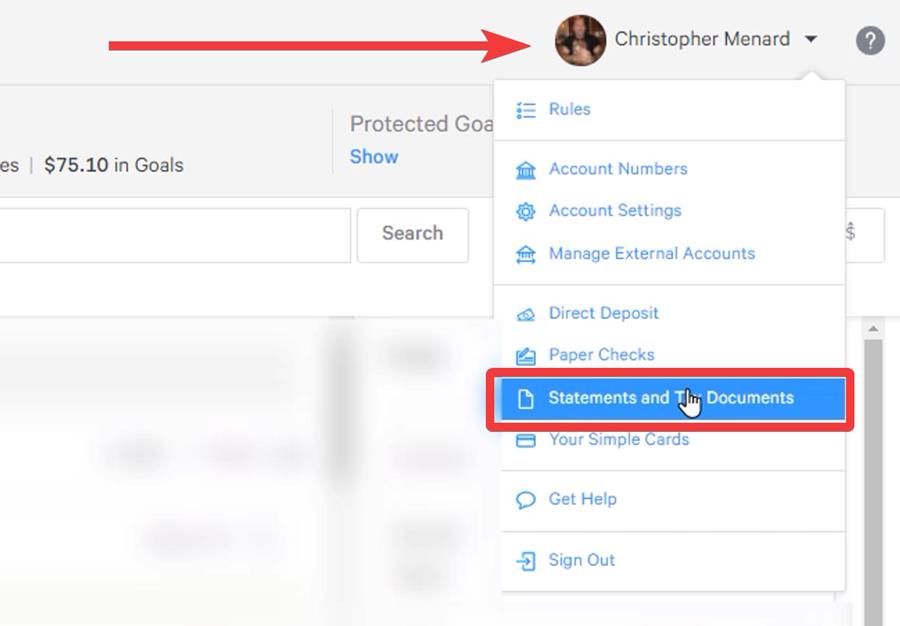

In the top-right, go to your profile picture and open the drop-down

-

Go to “Statements and Tax Documents”

-

Use the download link to download your statements.

Access Statements and Tax Documents menu in Simple Bank account

Download your statements from Simple Bank

Export Your Transactions History

Personally, I’ve been with Simple Bank since April 11th, 2015, so I have more than 5 years’ worth of transactions. It’s a good idea to download these for safekeeping. You can export all of your transactions to a CSV file, using the following steps.

How to export your transactions history:

-

Go to the main menu in your Simple Bank account

-

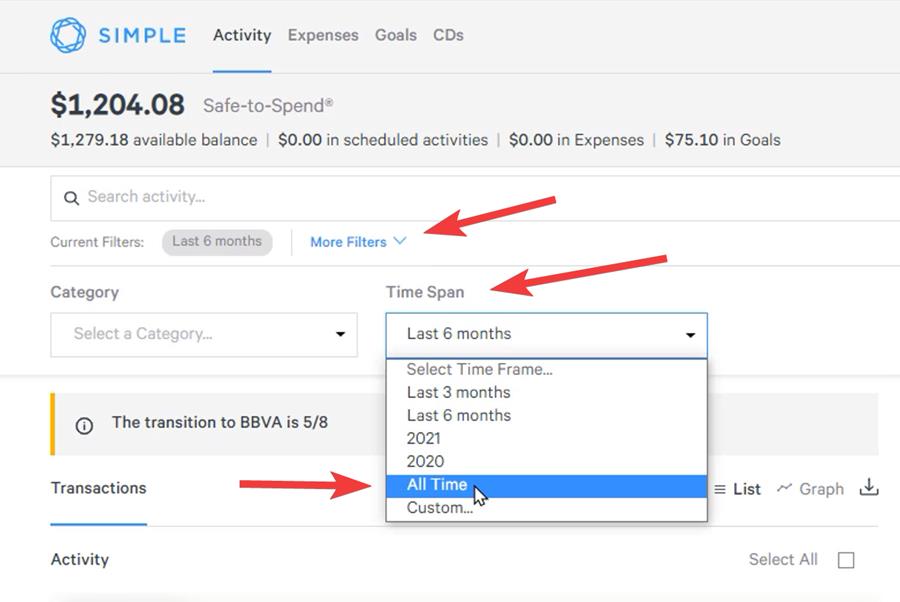

In the top-left, the default filter says ‘Six months’ – change the Time Span to ‘All Time’ from the drop-down.

-

Now the list will include all of your transactions.

-

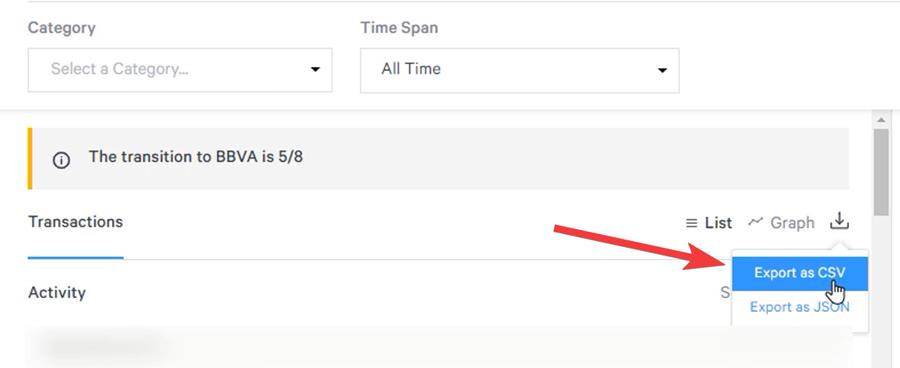

Click on the download icon and choose “Export as CSV”

Now you've got a list of all your transactions. Mine just downloads as a CSV file I can open in Excel if I want to. So I recommend you do that and then archive that file somewhere.

Change Simple Bank transactions filter to view all transactions

Export all your transactions as CSV from Simple Bank

Check deposits coming into your account

Whether you look through that Excel file that you just saved (CSV file), or you look through your statements or you scroll through your transactions online, look for any deposits into your account that are direct deposits.

For example, my Google AdSense money comes here, my payroll check comes here, so you don't want to close your account when you've got direct deposits coming into this account. You should move those first.

Check and move withdrawals to another account

Don’t do the above just for deposits, now look for any withdrawals from this account.

Maybe you have subscriptions such as Netflix charged out of here, maybe your car insurance comes out of here. Netflix would be easy. Just sign back into your Netflix account and change that to the new bank, but you don't want something like your car insurance - that may require some paperwork to get it changed – to be left without an account to pay from.

So make sure you move all of your withdrawals to one of your other bank accounts.

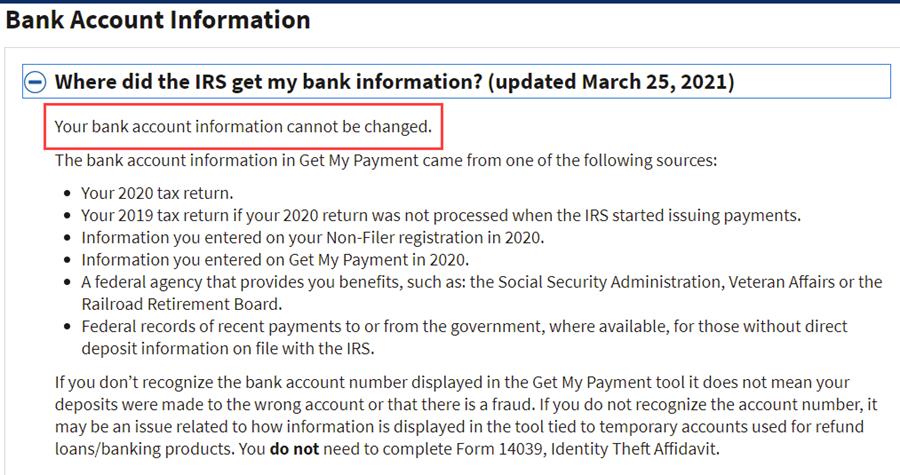

Don't close your account if you're expecting an IRS stimulus check

I don't know if there's going to be another stimulus check, but in case there is and your checks have been going to your Simple Bank account, you don't want to go change it because then you may end up getting a paper check.

I'm not 100% sure about this, but I don't believe the IRS will let you change your bank information for a stimulus check because of fraud.

These are my five reasons that I came up with. If you have any more, please let me know.

IRS webpage

IRS website info about bank account information

Transfer your balance out before closing the account

It goes without saying that before you close your Simple Bank account, you should move all your balance out to another bank account.

Make sure you've transferred your balance to another bank account before closing

How to close your Simple Bank Account

My wife was generous enough to tell me I can close her account. I do want to point out she has a zero balance at the top, so she took her money and put it into another bank.

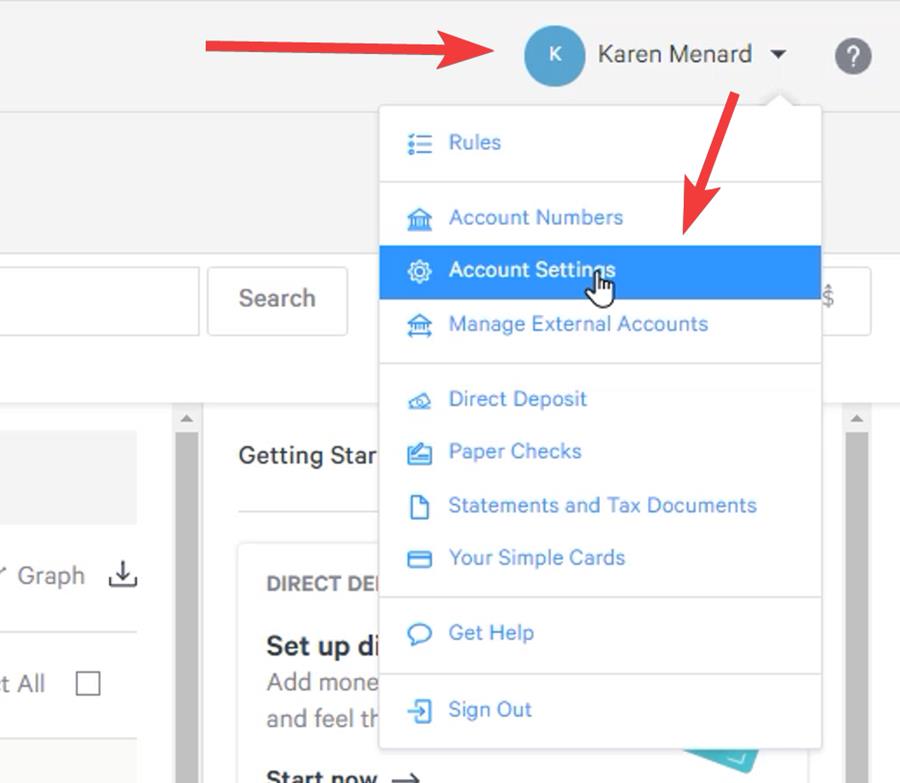

How to close your account:

-

Go to your profile picture on the top-right, click on the drop-down

-

Go to “Account Settings” and click

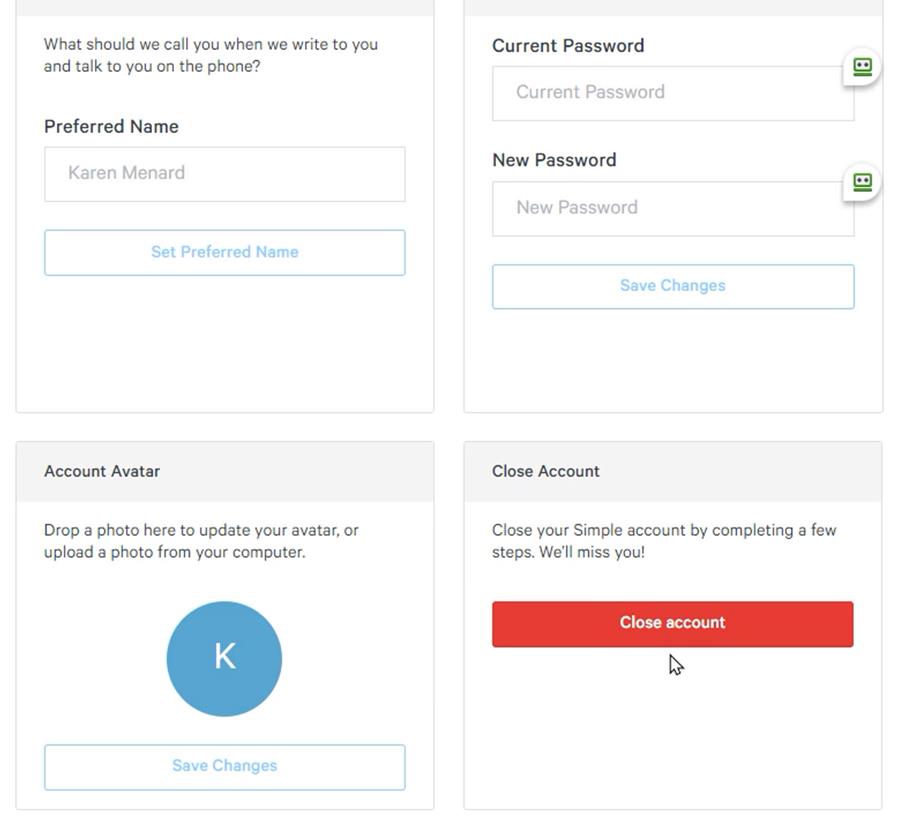

-

At the bottom, there should be a “Close account” button. Click that.

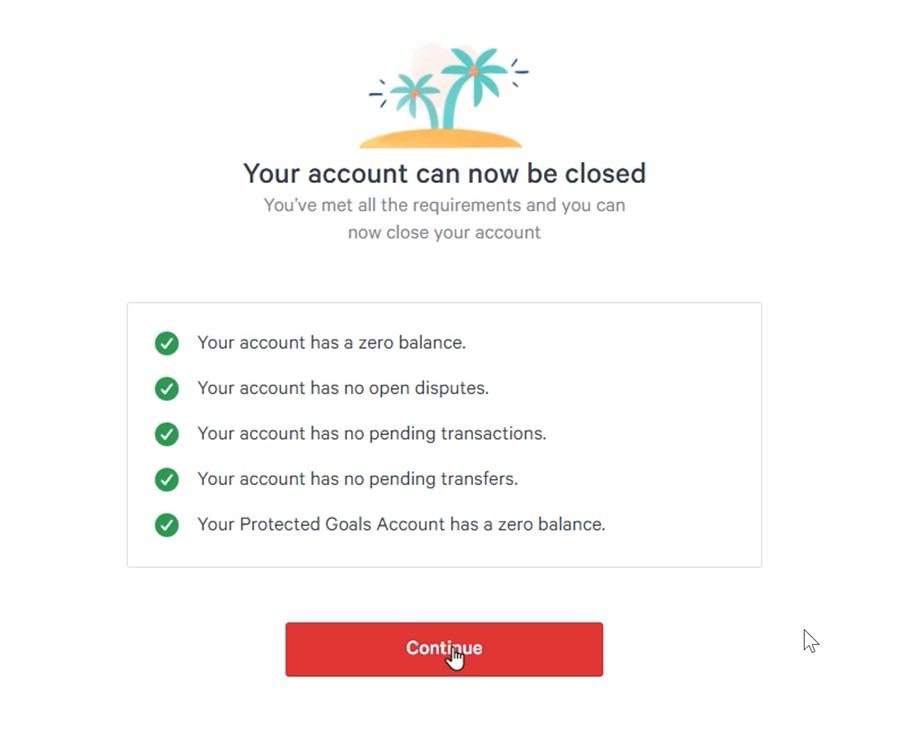

-

Check the confirmation screen: no disputes, pending transactions or any other reasons that might prevent the account from closing.

-

Click Continue on this screen, confirm and close.

Now your account with Simple Bank is closed.

Go to Account Settings in your Simple Bank account

Click the Close Account button to start the closing down process

Confirmation screen that Simple Bank account can be closed

If you have any questions about this article let me know. I'm going to be publishing more videos and articles regarding Simple Bank, how their mobile app works compare compared to BBVA.

What happens if I don't close my Simple Bank account?

One final thing, to be really clear about this: If you do nothing with your Simple Bank account, everything's going to be ok because your money is with BBVA USA already. BBVA acquired Simple in February 2014.

Watch my video describing the 5 things to do before closing down your Simple Bank account

Chris Menard

Chris Menard is a Microsoft Certified Trainer (MCT) and Microsoft Most Valuable Professional (MVP). Chris works as a Senior Trainer at BakerHostetler - one of the largest law firms in the US. Chris runs a YouTube channel featuring over 900 technology videos that cover various apps, including Excel, Word, PowerPoint, Zoom, Teams, Coilot, and Outlook. To date, the channel has had over 25 million views.

Menard also participates in 2 to 3 public speaking events annually, presenting at the Administrative Professional Conference (APC), the EA Ignite Conference, the University of Georgia, and CPA conferences. You can connect with him on LinkedIn at https://chrismenardtraining.com/linkedin or watch his videos on YouTube at https://chrismenardtraining.com/youtube.

Categories