PMT Function in Excel - how to use it to calculate loan payment

One of Excel's most popular financial functions is the PMT function. The PMT function will calculate your payments for a loan based on the interest rate, loan amount, and the number of periods. You would use the PMT function to calculate a car or house loan.

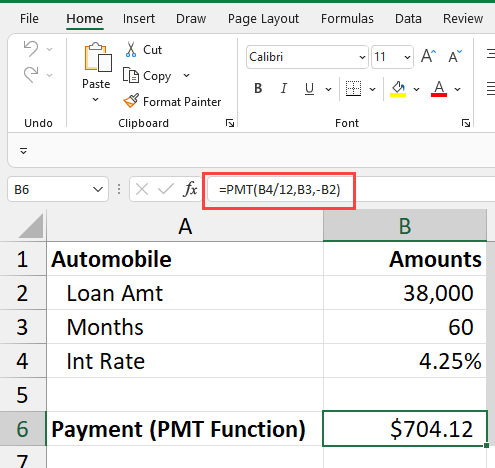

**PMT function for a car loan**

YouTube video

Excel PMT Function - house or car loan payment | Excel One Minute Quick Reference

PMT Function Syntax

**PMT(rate, nper, pv, \[fv\], \[type\])**

**Examples of the PMT Function**

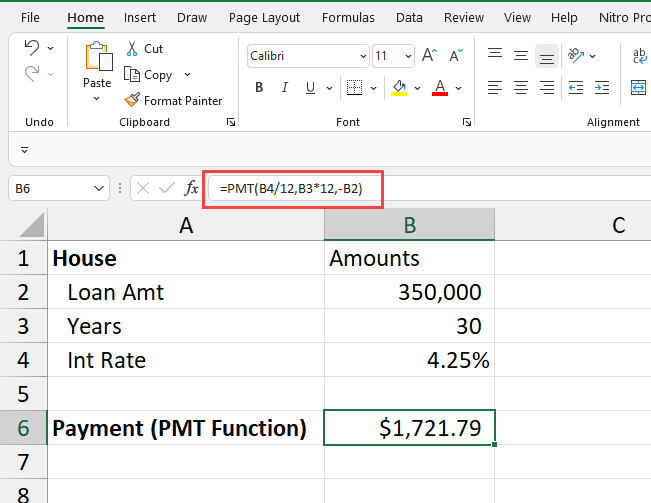

Example 1: **=PMT(4.25%/12,30\*12,350000)**

Example 1 is a PMT function not referencing cells. You will get a negative answer since it is money you have to pay. To make the answer positive, use -350000 in the formula.

Example 2: **=PMT(b4/12,b3\*12,-b2)**

Example 2 is referencing cells. See the screenshot below.

Five arguments in the PMT function

- rate - The interest rate for the loan. - nper - The total number of payments for the loan. - pv - The present value, or the total value of all loan payments now. - fv - \[optional\] The future value or a cash balance you want after the last payment is made. Defaults to 0 (zero). - type - \[optional\] When payments are due. 0 = end of the period. 1 = beginning of the period. Default is 0.

_Tip_: Wondering why \[fv\] and \[type\] are in square brackets? The brackets mean they're optional. If you don't include values for fv and type in your formula, Excel assumes your balance will be $0 at the end of the loan, and that your payments are due at the end of the period.

**PMT function for a house loan**|