The 4 Percent Rule: Using Microsoft Excel to Plan for Retirement

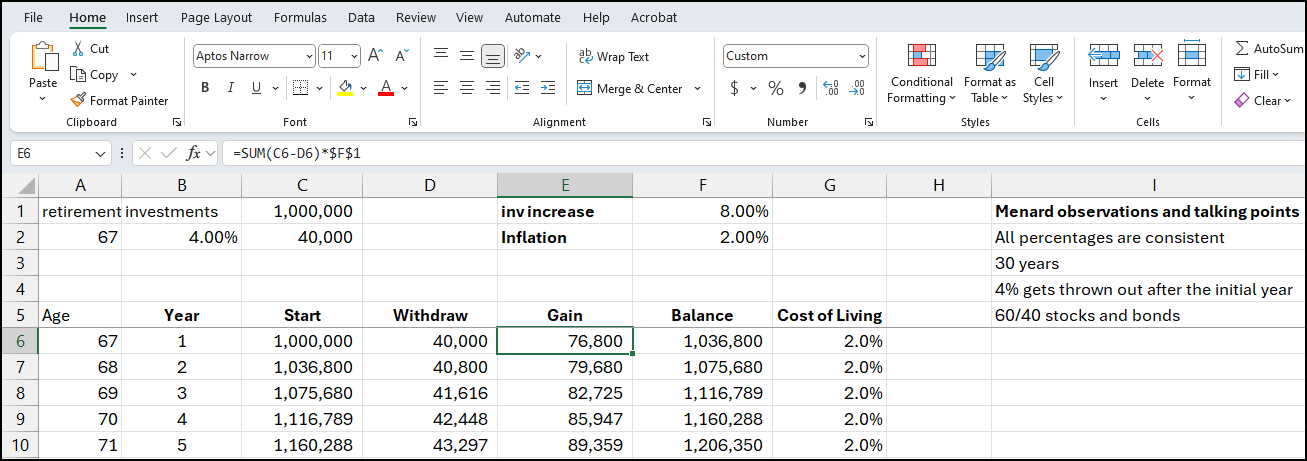

Exploring the 4 percent rule through Microsoft Excel provides a hands-on approach to understanding how it might apply to your retirement planning. The beauty of Excel is its ability to allow for tweaking and customization based on personal circumstances and the ever-changing economic landscape. The rule, originating from Bill Bengen's study in 1994, has stood the test of time, serving as a guideline for countless retirees aiming for financial stability. However, as the financial environment evolves, so too should our strategies and assumptions.

**Four percent rule for retirement**

Adapting the 4 Percent Rule

The original 4 percent rule was based on historical data and market conditions that have since transformed. Variables such as inflation rates, market volatility, and personal spending habits in retirement are crucial to consider in your calculations. By adjusting these inputs in Excel, you can visualize different scenarios and their outcomes on your retirement savings. This adaptability is key to creating a retirement plan that is robust yet flexible enough to weather economic fluctuations.

Other Articles about the 4% rule

- [Wikipedia - William Bengen](https://en.wikipedia.org/wiki/William_Bengen) - [Yahoo Finance - 4% rule article](https://finance.yahoo.com/news/even-inventor-bill-bengen-revisiting-143000007.html) - [Vanguard article](https://investor.vanguard.com/investor-resources-education/article/retirement-withdrawal-strategies#:~:text=The%20%224%25%20rule%22%20is,with%20the%20rate%20of%20inflation.)

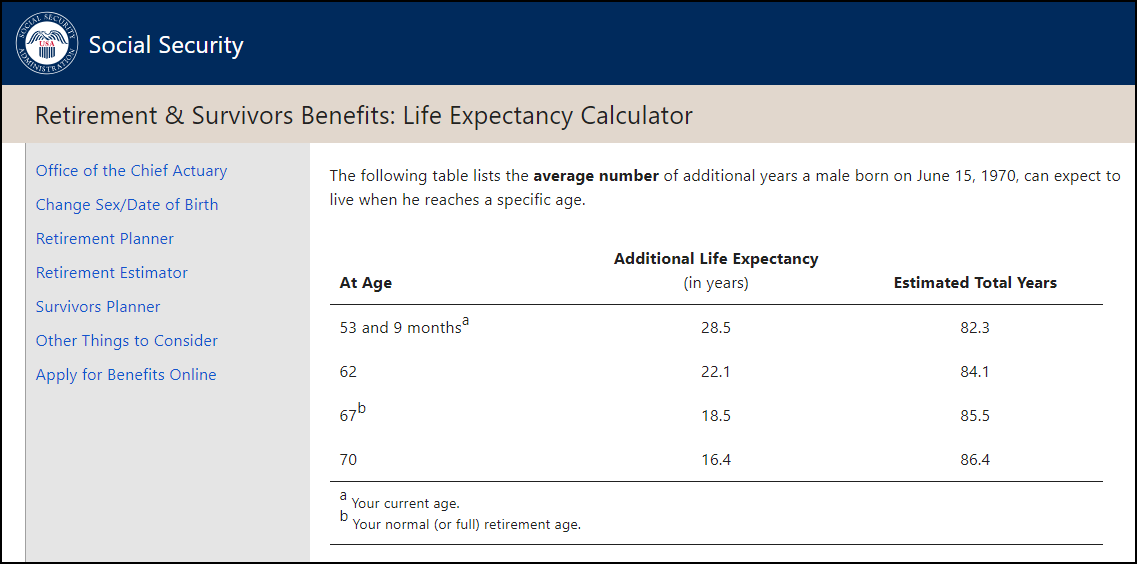

Considering Personal Factors

One size does not fit all when it comes to retirement planning. Personal factors such as

- life expectancy - health - retirement activities - taxes

significantly impact how much you will need to save. The 4 percent rule does not account for these variables, making it imperative to consider a cushion beyond the rule's guidelines. Additionally, integrating other income sources like Social Security benefits or part-time work can offer more security and flexibility.

[Social Security Life Expentancy Calculator](https://www.ssa.gov/oact/population/longevity.html)

(https://www.ssa.gov/oact/population/longevity.html)

**Social Security Life Expectancy Calculator**

YouTube video - 4 percent rule for retirement

The 4% Retirement Rule Using Microsoft Excel - YouTube

Continuous Learning and Adjustment

Staying informed and adjusting your plan as you approach retirement and even during retirement is crucial. Economic conditions, market performance, and personal circumstances will change, requiring a revisit and revision of your plan. Engaging with financial news, utilizing financial planning tools, and consulting with a financial advisor can provide insights and assist in navigating these changes effectively.

Resources for Further Exploration

- Financial planning software: Many tools are available that go beyond Excel, offering more sophisticated simulations and financial planning features.

- Books and publications: Numerous books delve into retirement planning strategies, including the specifics of the 4 percent rule and its adaptations over time.

- Online courses: Educational platforms offer courses in personal finance and retirement planning, providing a structured approach to understanding and applying these concepts.

- Financial advisors: Consulting with a professional can provide personalized advice tailored to your unique situation, taking into account the nuances that a generic rule might overlook.

In conclusion, the 4 percent rule serves as a starting point in the journey of retirement planning. By leveraging tools like Microsoft Excel and other retirement planning software like [NewRetirement](https://www.newretirement.com/), you can begin to explore how this rule applies to you and start the process of building a tailored retirement strategy. Remember, the goal is not to strictly adhere to this rule but to use it as a framework for understanding your retirement needs and creating a plan that ensures financial security and peace of mind during your retirement years.