How to Purchase T-Bills from Treasury Direct: Step-by-Step Guide

Purchase T-Bills from Treasury Direct directly from the U.S. Treasury to earn higher returns than many bank accounts, avoid brokerage fees, and manage short-term cash with predictable safety. This guide explains what you need, how the process works, and the practical steps I follow to buy Treasury bills on TreasuryDirect.gov.

Table of Contents

- 📝 What are T-Bills and why buy them?

- 🔍 What you need to open a TreasuryDirect account

- 🔐 Log in and two-step verification

- 💻 What you can buy on TreasuryDirect

- 🛒 Step-by-step: How to purchase T-Bills from Treasury Direct

- 📈 How T-Bill pricing and yield work (simple)

- 🧾 Practical examples and laddering

- ⚠️ Common mistakes and what to watch for

- 🔁 Reinvestment and automatic rollovers

- 💳 Funding and settlement

- 🔎 Brokerage vs TreasuryDirect — quick comparison

- 🧾 Checklist before you hit Buy

- ✅ Key takeaways

📝 What are T-Bills and why buy them?

Treasury bills, or T-Bills, are short-term U.S. government securities with maturities from 4 to 52 weeks. They are issued at a discount to face value and pay no periodic interest. At maturity, the Treasury pays the face value, and your return is the difference between the purchase price and the face value. I use T-Bills to park cash I might need within a few weeks up to a year while earning more than a typical savings account.

🔍 What you need to open a TreasuryDirect account

Before you can purchase T-Bills from Treasury Direct, gather these items:

- Social Security Number (or Tax ID)

- U.S. residential address

- Valid email address (TreasuryDirect sends account numbers and one-time passwords)

- Bank account number and routing number for ACH transfers (verifiable)

- Create a password and security question during setup

Account setup typically takes under 15 minutes. Keep the TreasuryDirect account number and OTP email safe after registration.

🔐 Log in and two-step verification

After you create your account, TreasuryDirect uses a one-time password (OTP) sent via email to verify your login.

💻 What you can buy on TreasuryDirect

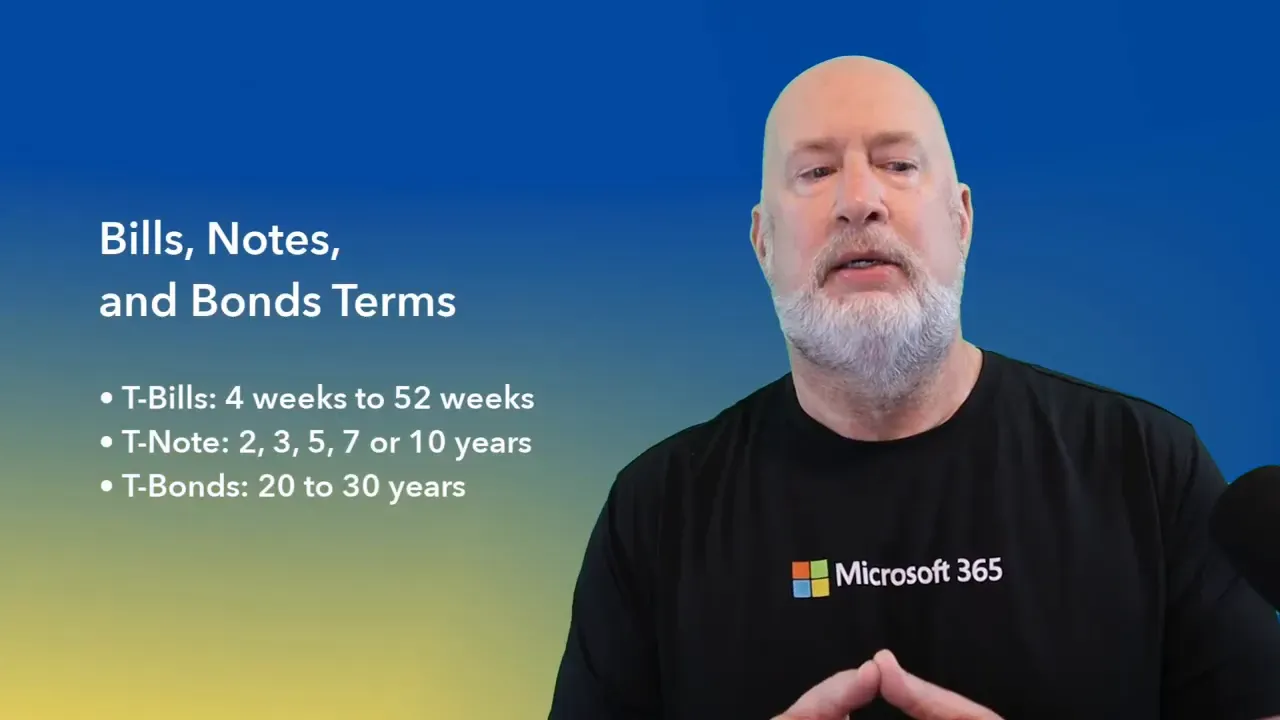

TreasuryDirect sells only U.S. Treasury securities. The main choices are:

- T-Bills — 4, 8, 13, 26, and 52-week maturities (discount)

- T-Notes — 2, 3, 5, 7, and 10-year maturities (coupon-bearing)

- T-Bonds — 20- and 30-year maturities (coupon-bearing)

- Series I and EE savings bonds

Note that you cannot buy stocks, mutual funds, or ETFs directly on TreasuryDirect. If you prefer, brokerages such as Vanguard, Fidelity, or Charles Schwab also allow you to buy Treasuries, but I often choose TreasuryDirect to avoid brokerage fees and hold securities directly in a government account.

YouTube Video on buying Treasury Bills

🛒 Step-by-step: How to purchase T-Bills from Treasury Direct

- Sign in to your TreasuryDirect account.

- Choose "Buy Direct" and select "Bills" from the product list.

- Pick a maturity (4–52 weeks). Check the auction date and issue date that match each offering.

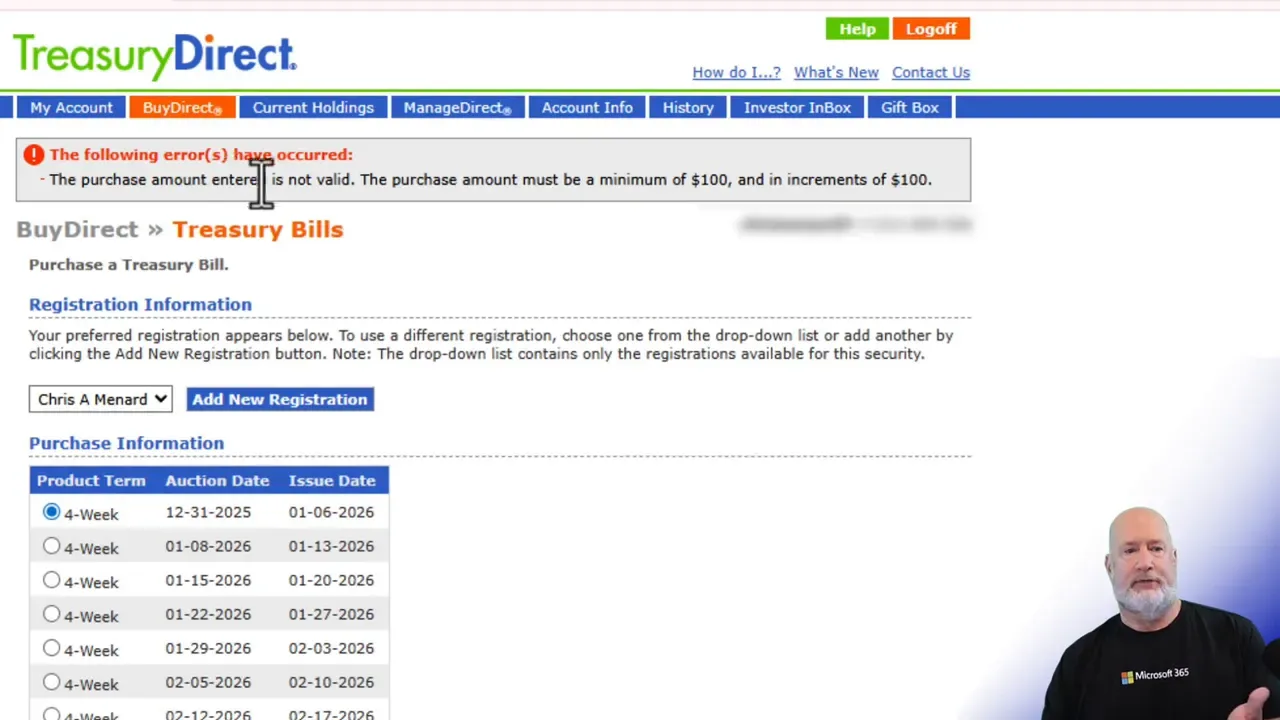

- Enter a purchase amount in $100 increments. The minimum is typically $100.

- Select reinvestment to enable automatic rollovers at maturity.

- Confirm your linked bank account for the ACH debit at settlement.

- Review and submit the purchase. You will receive confirmation of the auction and eventual purchase price.

When I buy, I often choose a 4-week bill for short-term cash needs or ladder bills across several auction dates to smooth returns and liquidity.

📈 How T-Bill pricing and yield work (simple)

T-Bills are sold at a discount. The yield depends on the discount amount and the time to maturity. A simple approximate yield formula for a T-Bill is:

Yield ≈ (Face Value - Purchase Price) / Purchase Price × (365 / Days to Maturity)For calendarized yields, investors often use bank discount yield or annualized return conventions. You can check auction results after issuance to see the exact purchase price and yield assigned to your allocation.

🧾 Practical examples and laddering

Example: You want to deploy $3,000 in short-term cash. A simple ladder:

- $1,000 in a 4-week bill

- $1,000 in a 13-week bill

- $1,000 in a 26-week bill

Each bill matures on a different date, providing recurring liquidity and the opportunity to reinvest at current rates. You can adjust amounts in $100 increments and mix maturities based on cash needs.

⚠️ Common mistakes and what to watch for

- Incorrect purchase increments — TreasuryDirect enforces $100 increments. Submitting $75 will generate an error.

- Forgot OTP or wrong email — Keep the registration email current; TreasuryDirect sends critical login and account information there.

- Expecting periodic interest — T-Bills do not pay interest during the term; they are discounted instruments.

- Confusing auction and issue dates — The auction date is when bids are accepted; the issue date is when the security begins accruing to you, and settlement happens.

- Thinking TreasuryDirect sells everything — You cannot buy ETFs, stocks, or non-Treasury securities on TreasuryDirect.

🔁 Reinvestment and automatic rollovers

TreasuryDirect offers an automatic reinvestment option for T-Bills. If you select reinvest, at maturity, your proceeds are used to purchase the next available bill with the same maturity. I sometimes opt out of reinvestment to retain flexibility, but automatic rollovers work well for a buy-and-hold ladder.

💳 Funding and settlement

Purchases are settled via ACH from your linked bank account. TreasuryDirect will debit your account at settlement for successful allocations. Verify your bank account during setup; TreasuryDirect may perform micro-deposits or verification steps.

🔎 Brokerage vs TreasuryDirect — quick comparison

- TreasuryDirect: Direct ownership, no brokerage fees, simple interface for Treasury-only holdings, ideal for investors who want a direct Treasury relationship.

- Brokerage: Consolidation of all investments in one place, often easier trading and laddering tools, may charge fees or require minimums for certain services.

I choose based on convenience: if I already manage accounts at a brokerage and prefer one dashboard, I may buy Treasuries there. If I want zero fees and direct ownership, I use TreasuryDirect.

🧾 Checklist before you hit Buy

- Linked bank account verified

- Email confirmed and OTP accessible

- Purchase amount in $100 increments

- Chosen maturity and reinvestment preference set

- Understanding that T-Bills pay at maturity (discount)

✅ Key takeaways

Purchase T-Bills from Treasury Direct when you want safe, short-term investments with predictable maturity, no brokerage fees, and direct government backing. Use laddering or reinvestment to manage liquidity and returns. Confirm account setup details and $100 increment rules to avoid errors during purchase.

How soon will my funds be used after I submit a purchase?

Settlement happens on the issue date listed for the auction. Your linked bank account will be debited on settlement for your allocated amount. Check the auction and issue dates before confirming a purchase.

What is the minimum I can buy?

The minimum is typically $100, and purchases must be in $100 increments. Attempting amounts below this or not using $100 steps will produce an error in TreasuryDirect.

Can I sell a T-Bill before maturity in TreasuryDirect?

TreasuryDirect is designed for buy-and-hold. To sell a security before maturity, you generally need to transfer it to a brokerage account that can execute secondary market trades.

How do I calculate the yield on a T-Bill?

T-Bills are discounted. The approximate annualized yield equals (Face Value minus Purchase Price) divided by Purchase Price, annualized based on days to maturity. For exact yields, use official auction results or a financial calculator.

Following these steps will help you purchase T-Bills on TreasuryDirect confidently and efficiently. If you want exact auction results and assigned yields after a purchase, consult the Treasury auction reports on TreasuryDirect or your TreasuryDirect account history.