Liquidity Ratio using Excel: Chris Menard Training

A liquidity ratio is a type of Financial Ratio that determines if a company can pay its short-term debt and obligations with its current assets. The higher the liquidity ratio, the better.

What are Current Assets?

Current Assets consist of cash and other assets expected to be converted to cash within a year.

Examples of Current Assets:

1. Cash 2. Cash Equivalents 3. Accounts Receivable 4. Inventory 5. Prepaid Expenses 6. Other Liquid Assets

Liquidity Ratios

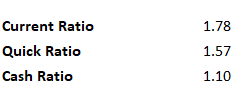

1. Current Ratio 2. Quick Ratio 3. Cash Ratio

**Liquidity Ratios**

YouTube video of Liquidity Ratios

Excel: Liquidity Ratios - Current Ratio, Quick Ratio, & Cash Ratio

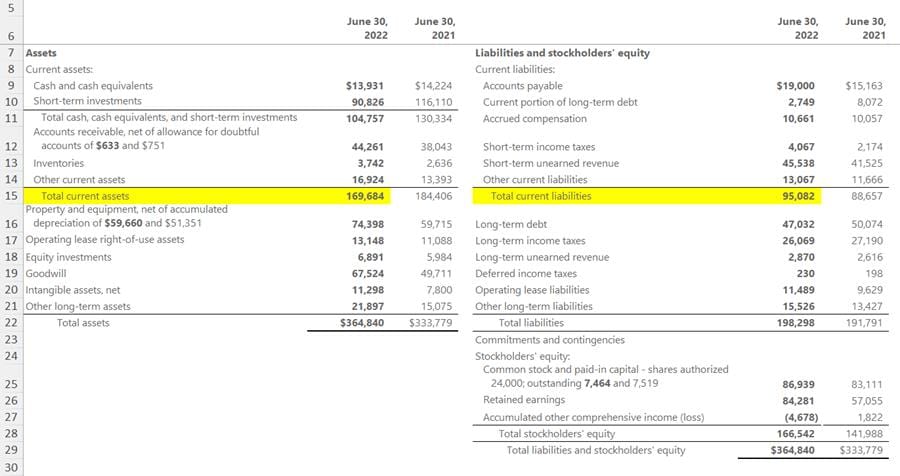

The current ratio compares current assets to current liabilities.

Current Ratio Formula

Current Assets / Current Liabilites

**Current Ratio - Current Assets / Current Liabilities**

**169,694 / 95,082 = 1.78**

Quick Ratio

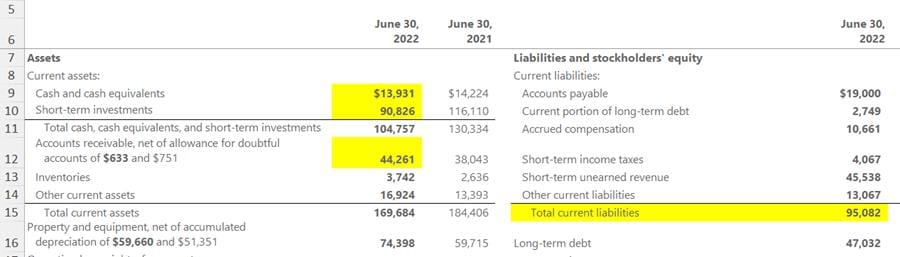

The quick ratio compares highly liquid current assets to current liabilities.

Quick Ratio Formula

Cash + Cash Equivalents + Marketable Securities + Net Accounts Receivable / Current Liabilites

Notice that inventory and prepaid expenses are not included in the quick ratio.

**Quick Ratio**

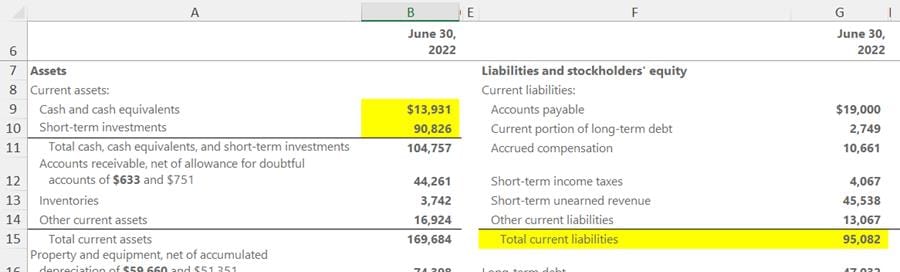

**(13,931+90,826+44,261) / 95,082 = 1.57**

Cash Ratio

The cash ratio compares highly liquid current assets, cash and cash equivalents to current liabilities.

Cash Ratio Formula

Cash + Cash Equivalents / Current Liabilites

Notice that accounts receivable, inventory, and prepaid expenses are not included in the cash ratio.

**Cash Ratio**

**(13,931+90,826) / 95,082 = 1.10**

Liquidity Ratios Observations

A few observations:

1. Notice the ratios goes down from 1.78, the current ratio, to 1.10 for the quick ratio. The numbers go down as current assets are eliminated. 2. All three ratios are based on current liabilities. 3. There are other liquidity ratios. Only three are covered in this article.

**Ratios goes down as assets are eliminated from the formula**